untie (a person)

October 22nd.

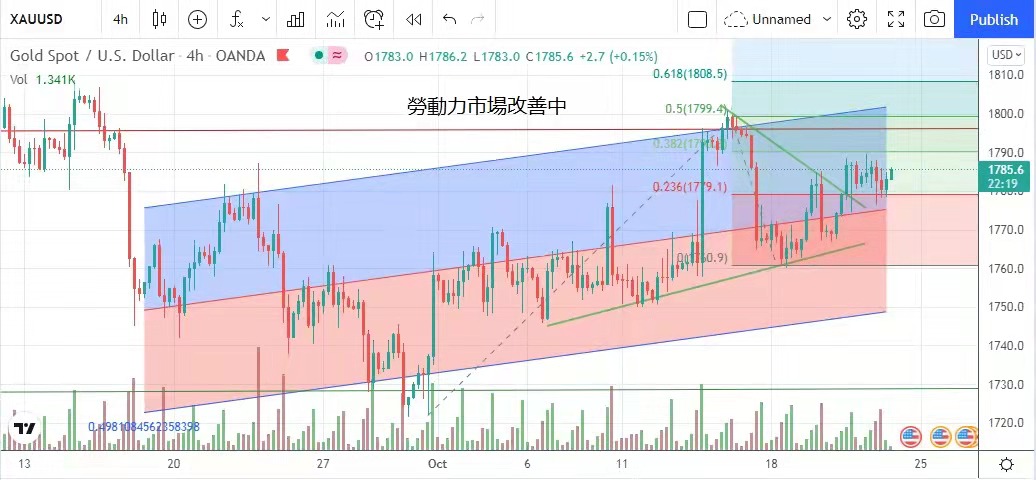

Today's volatility range:

The market had expected the Federal Reserve to start reducing its bond purchases in November, but the United States announced that the number of people applying for unemployment benefits for the first time fell again last week, hitting a new low since the epidemic, reflecting the continuous improvement of the labor market.

The news will not only strengthen the implementation of the Fed's table reduction action, but also accelerate the Fed's rate hike. Gold price hit USD 1,790 for two consecutive days, but it was supported at USD 1,778. Yesterday, it rose slightly after long and short battles.

Only the pace of the Fed's interest rate increase may affect the performance of the gold market. Today, it is suggested that the volatility should be between 1775 and 1790 US dollars.

Following the speech made by Vice Premier Liu He of the State Council, saying that there are some problems in the real estate market, but the risks are generally controllable, China Banking Regulatory Commission also named Evergrande Real Estate as an individual phenomenon yesterday, which will not affect the reputation of Chinese-funded enterprises.

It has too much influence, and thinks that the related risks of Evergrande are controllable. China Banking Regulatory Commission tried to strengthen market confidence. In addition, Liu He hinted earlier that three red lines might be relaxed, and the interior housing stocks were built because liquidity was expected to be loosened.

Only China Evergrande's sale of Evergrande property to Hesheng Chuangzhan fell through, and its shares resumed trading yesterday. Evergrande and Evergrande's property declined sharply, ranging from 8% to 12%. Hong Kong stocks finally retreated after rising for 4 days, and they were listed in Kewang.

And power stocks retreated as a whole, the Hang Seng Index fell 0.35% yesterday, sticking to the 26,000 mark.

The World Bank published the report "Commodity Market Outlook", which predicted that energy prices will continue to rise next year after rising by more than 80% this year, but the increase will be narrowed, but it described the benefits that will be brought to many developing countries.

Great risks. Sustained inflation has warmed up risk aversion, with three major European stock markets falling, and Germany's DAX index falling by 0.32%. France Paris CAC index fell 0.29%; Britain's FTSE 100 index fell 0.45%.

Individual development of American stock market, Tesla's quarterly performance is ideal, leading a group of technology stocks, pushing the Standard & Poor's 500 Index to break the peak and generate a new high in the market. It rose for the seventh consecutive day yesterday, and then rose by 0.3% to close the market.

It also rose by 0.62%. However, the international business machine announced that its performance was lower than expected, which made the whole family tired. The Dow Jones index closed down 0.02%.

Yesterday, the gold market was contending for long and short positions. Continued inflation warmed up the risk aversion, and the anti-inflation ability of gold prices increased. However, the United States announced that the number of people applying for unemployment benefits for the first time last week fell to a new low since the epidemic, reflecting the labor force.

In the gradual improvement of the market, Bostic, president of Atlanta Federal Reserve Bank, even said that the Fed may start to raise interest rates as soon as the third quarter of next year, and the yield of US 10-year Treasury bonds will rise first in response to the news, offsetting most of the gold price.

Increase. Yesterday, the low price of gold was $1,777, and the highest price rose to $1,790, which benefited from the expectation of raising interest rates, and finally closed at $1,783, rising to $1.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator.

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram