Ruthless blow

July 19 th

Today's volatility range:

Due to the epidemic situation in Europe and natural disasters, investors turned to the US dollar to avoid risks, while the euro and pound were soft against the US dollar, and the US dollar index once surged to 92.7, which suppressed the growth momentum of gold prices.

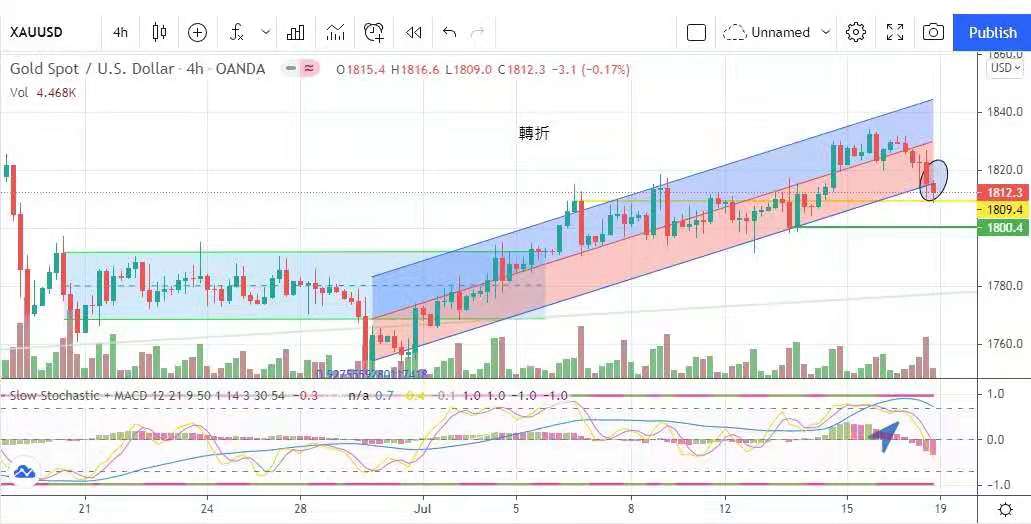

In addition, investors are worried that runaway inflation will accelerate the possibility of the Fed's early contraction, so the gold price is under pressure and finally falls to the turning point of $1,812. I believe there will be a chance to try the low level again next week, but it is expected that $1,800 will be supported.

Out-of-control inflation has become a concern of Fed officials, and the Fed will explain it again on the 29th of this month, but I believe that when the economy has not fully recovered, especially when the employment level has not reached the pre-epidemic level,

It is difficult for the Fed to push forward and shrink its schedule. It is expected that the price of gold will still be a volatile market before the interest rate split in July. Today, the suggested volatility is between 1800 and 1820.

Earlier, China's State Internet Information Office conducted a network security review of technology companies, including requiring companies with 1 million or more user data to apply to the authorities for sale before listing overseas.

To ensure that key information, infrastructure and supply chain are stable enough to maintain national security standards, and the listing documents can only be submitted after approval. After the news came out, many Chinese companies stopped urgently and attached the listing plan in the United States.

The Hong Kong Stock Exchange has the opportunity to accept some of these companies to list in Hong Kong. The Hong Kong Stock Exchange was given the opportunity to kill chickens, and Beishui took the lead in responding, increasing the southbound flow and stimulating the rise of Hong Kong stocks. The Hang Seng Index closed slightly by 0.03% on Friday.

The new crown virus Delta, which is more transmissible, has become an obstacle to the global economic recovery again. Fauci, director of the National Institute of Infectious Diseases of the United States, said on Friday that about 100 countries have now found Covid-19 Delta variant virus strains.

And began to dominate the world, saying that the world is dealing with a terrible variant virus. Although vaccination program is a more effective way to contain the virus at present, with the uneven distribution of vaccines and globalization,

Inevitably drag each other down. British Prime Minister Johnson announced at the beginning of this month that he would relax the restrictions on Covid-19. He plans to end the social distance restrictions in the UK today, including lifting the restrictions on the number and location of people meeting in social occasions; and

Cancel the mask order. However, on the eve of the implementation of the policy, bad news came again on Thursday and Friday. On average, there were more than 50,000 new confirmed cases of pneumonia in Britain in two days, which reached a new high in half a year.

In addition to being ruthlessly hit by the epidemic, Europe also experienced a rare natural disaster in a hundred years. Germany was hit by heavy rain, with an estimated missing population exceeding 1.3 thousand. On Friday alone, at least 126 people were killed together with neighboring Belgium.

The economic losses caused by floods are estimated for the time being. The epidemic and natural disasters shattered European stock markets, and the three major European indexes fell for the fourth consecutive day. The German DAX index fell 0.57% and the French Paris CAC index fell 0.51%;

Britain's FTSE 100 index fell 0.06%. In terms of U.S. data, the U.S. released the July Consumer Confidence Index on Friday night, and the results showed that the people were not optimistic about the economic prospects of the U.S.. Consumers thought that as the epidemic slowed down,

The economy will recover, but while the employment situation is still sluggish and wages have not improved, prices are growing rapidly. Curbing accelerated inflation has become a public concern, which will cause Fed officials to pay attention to it next time

The pressure of meeting on interest rate.

The market is worried that runaway inflation will accelerate the possibility of the Fed's early contraction. Coupled with the rebound of the US epidemic, the three major Wall Street indexes reported losses on Friday, with the Dow Jones index falling 0.86% and the Standard & Poor's 500 index falling 0.77%.

Nasdaq index fell for four consecutive days, down 0.8% to close. The epidemic and natural disasters shook the European stock markets, investors turned to the US dollar to hedge, the euro and the pound were soft against the US dollar, and the US dollar index once surged to 92.7.

This operation suppressed the growth momentum of gold price. In addition, investors are worried that runaway inflation will accelerate the possibility of the Fed's early contraction, and the price of gold is under pressure, eventually falling by US$ 17 at US$ 1,812. In a week,

It went up by four dollars.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram