Buddhism is The Machine

June 18 th

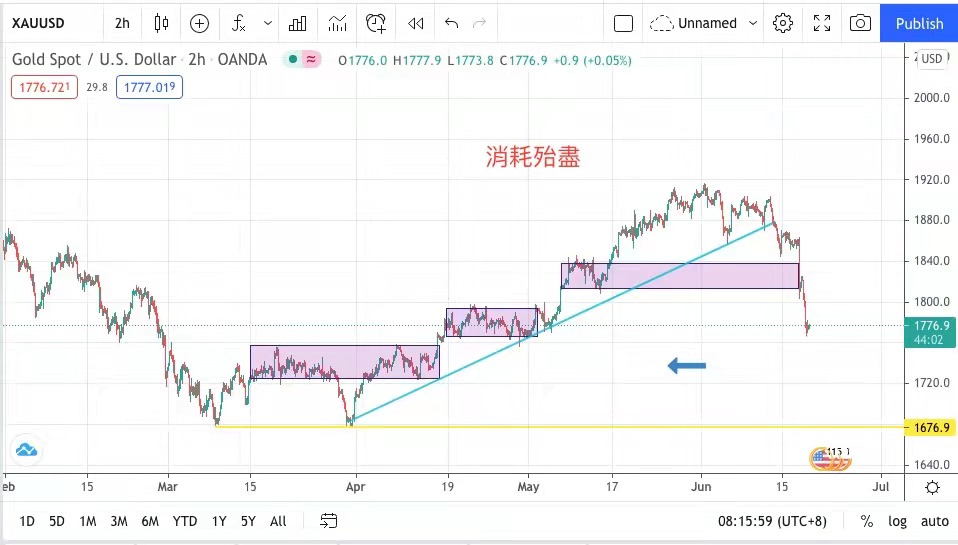

Today's volatility range:

The labor and manufacturing index released by the United States yesterday was worse than market expectations, but it was still not enough to reverse the market's fear of the Fed's expected interest rate hike. The US dollar index approached 92 points, and the Fed used fine-tuning

Small moves such as reverse repurchase rate and excess reserve rate show the determination to collect water, and the price of gold continues to drop sharply. From the trend point of view, the gold market has almost risen for a long time from March to April for two consecutive days

Can be exhausted, the next step is to test 1725/56. Today, the proposed amplitude is 1760-1783, extending the resistance in 1795.

The epidemic situation in Hong Kong is gradually under control, but many industries, such as civil aviation, port transportation and tourism, are still in dire straits. Although the latest unemployment rate in Hong Kong announced yesterday fell to 6%, it was lower than the expected 6.2%.

According to a survey conducted by a local labor organization, 34% of the respondents said they had been unemployed for more than one year, and 30% of them said they had no income at all in the past year! Some experts pointed out that the unemployment rate was due to the epidemic

Some improvements have been made, and the government has relaxed social isolation measures, so that some industries can employ more employees, such as catering and tutorial schools. The recruitment of tourism as temporary workers by the government in vaccination centers will also help reduce the recent unemployment rate,

However, in the long run, the key is to deal with the epidemic situation., If the epidemic situation in Hong Kong is not cleared in one day, customs clearance will not be completed in one day, and the economy and employment will deteriorate rapidly. Experts criticized the government for its inadequacy in helping the public.

Still indifferent to the establishment of unemployment cash allowance, describing senior officials as using "Buddhist" means in policy implementation, but looking at people's needs with "The Machine" and turning a blind eye!

After falling for seven consecutive trading days, the Hong Kong stock market finally rebounded, and the Hang Seng Index rose 0.43%. The French government just announced that it would end the curfew and mask order 10 days earlier, but the new pneumonia epidemic in Britain continued to deteriorate.

On Wednesday, 9,055 more confirmed cases were announced, the most since February 25th. The House of Commons passed by a large majority, and the date of revoking the final stage of the epidemic prevention measures in England was postponed for four weeks until next month 19th. Health Minister Xia Guoxian said,

Delaying the relaxation of social epidemic prevention measures is in the hope that more time can be spared so that more citizens can complete the vaccination against fatigue, so as to expand the group's immune function. The consumer price index of Eurozone residents announced yesterday increased by 0.2%, which was in line with market expectations.

The three major European stock markets developed individually, among which the British stock market was dragged down by fatigue, ending five consecutive rises. The German DAX index raise by 0.11%; The CAC index in Paris, France rose by 0.20%; Britain's FTSE 100 Index drop 0.44%.

After the Federal Reserve decided to raise the overnight reverse repurchase rate, the market demand for reverse repurchase soared to a record high. Yesterday, the reverse repurchase instrument recovered $756 billion overnight and put it in the Federal Reserve, setting a new record high of $584 billion last week.

Due to the flooding of the US dollar financing market, the demand for the Fed's reverse repurchase tools is increasing. The Federal Reserve announced that it would fine-tune the reverse repurchase rate from zero to 0.05%, and raise the excess reserve rate by 5 basis points to 0.15%.

It will also help the Fed absorb hot money and prevent the economy from overheating and forcing high inflation. With the interest rate hike and the small move of the Federal Reserve to collect water, the bank stocks immediately led the New York stock market to fall. On the contrary, technology stocks were sought after, and the three major indexes on Wall Street were high and low.

Dow Jones index fell 0.62%, Standard & Poor's 500 index fell 0.06%, Nasdaq index rose 0.87%.

In terms of data, the United States announced yesterday that the number of first-time jobless claims in the United States increased by 412,000 last week, which was worse than expected, and it was the first increase in more than a month. Another data also disappointed the market, that is, the manufacturing industry of the Federal Reserve Bank of Philadelphia, USA

The index is 30.7 points, which is not up to expectations. Both data show that there are still difficulties in the recovery of the job market. The labor and manufacturing indices released by the United States yesterday were worse than market expectations, but they were still not enough to reverse the market's fear of the Fed's expected interest rate hike.

As the US dollar index approaches 92 points, the long-term gold investors are completely incapable of parry. The gold collar rebounded to yesterday's high of 1825 yuan in the early stage, and then plunged to 1767 US dollars, with a drop of more than 58 US dollars at most, and finally rebounded slightly to close at 1773 US dollars.

Still down $39.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram