Who will be the next chairperson of the Federal Reserve? A Comprehensive guide to Market Expectations

Recently, Trump said that he has selected three to four candidates and is ready to succeed Federal Reserve Chair Powell. Although the chairperson has not been officially changed yet, market reactions have already emerged: the US dollar has declined, gold has rebounded, and expectations of interest rate cuts have risen.

As is known to all, the chairperson of the Federal Reserve, to a certain extent, represents the direction of interest rates in the coming years. As soon as the market hears the list of candidates, it will immediately interpret: Will there be a reduction in interest rates? How should the funds be deployed?

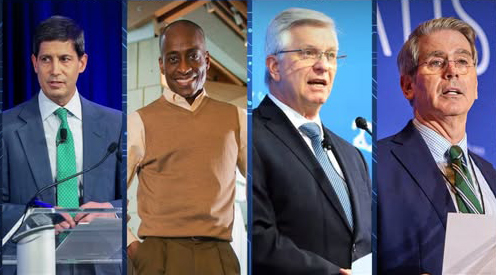

The four potential candidates currently circulating:

Kevin Warsh (Biased Eagle) | Former Governor of the Federal Reserve

It has always supported raising interest rates earlier and advocated fighting inflation

If he takes the stage, the market expects that high interest rates will persist for a relatively long time, which is beneficial to the US dollar and gold

Philip Jefferson (dovish) | Current Vice Chairman

Pay attention to economic equity, employment and the space for interest rate cuts

After entering the market, it may promote loose policies, which is beneficial to gold and risky assets

Christopher Waller (Neutral to Hawkish) | Current Director

Advocate acting based on data and have a pragmatic style

Market expectations have not changed much, but the pace of interest rate cuts may be relatively slow

Leslie Bessent (position unknown) | Former Investment Director of Bridgewater

There is no clear public stance, but it has a close relationship with Trump

The market is mainly on a wait-and-see basis, and short-term fluctuations may be significant

How do investors deploy?

The candidates tend to be dovish (that is, in favor of interest rate cuts).

Funds may flow into gold, technology stocks and emerging markets

The candidate tends to be hawkish (that is, advocating for interest rate hikes).

The US dollar may strengthen, and funds tend to flow back to defensive assets such as US Treasuries or bank stocks

The candidate is unclear/controversial

The market may experience repeated fluctuations in the short term. We are waiting for more clues to be confirmed

The market had already shifted before the chairman took the stage.

This time, Trump voluntarily mentioned three to four candidates, sincerely hoping that the market would be mentally prepared. Or will he use "expectation management" to influence the market atmosphere in advance? It can only be affirmed that the market always trades news faster than facts.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram