Gold prices stabilized at 3,400 for the first time as geopolitical risks rose

Last week, the gold price rose steadily. Israel launched an air strike on Iran, and Iran threatened to retaliate, saying that the world would see why Iran needed to develop nuclear weapons technology. The geopolitical risk was extremely high, which stimulated funds to flow into the gold market for safety. The gold price rose nearly 150 US dollars from high to low throughout the week and hit a two-month high, moving towards the historical high of 3,500.

At the beginning of the week, the trade dispute between China and the United States seemed to have a turn for the better. Although the US earlier claimed that China had violated the previous Geneva trade agreement, the opportunity for the heads of the US and China to hold talks still alluded to market concerns, causing the gold price to struggle around 3,300 and lacking the ability to break through upward significantly. The US released the CPI data in the middle of the week, which was lower than expected. Whether the inflationary pressure is significant or not, the Federal Reserve has more room to cut interest rates, which supports the development of gold prices. Gold prices have begun to challenge the two-week high.

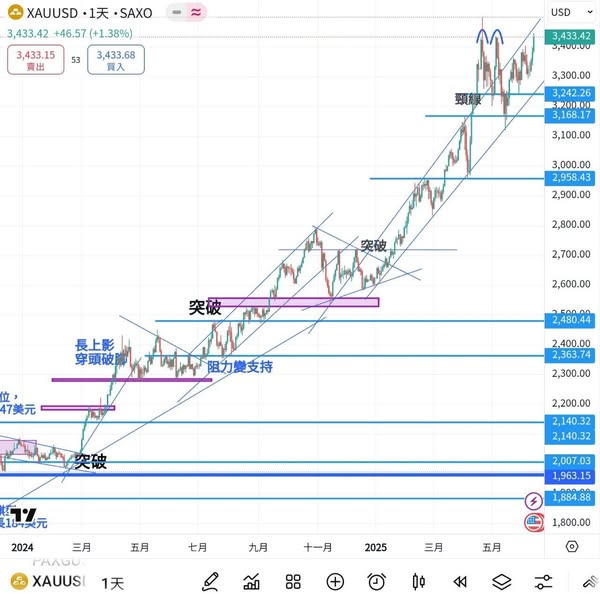

On the other hand, geopolitical risks have sharply increased. The United States has asked its ambassadors and nationals in the Middle East to withdraw, and the situation in the Middle East has become tense. Although there have been new developments in the China-Us negotiations, with the United States obtaining rare earths and China's tariffs being determined, the decline in gold prices has not been significant. On Friday morning, Israel launched an air strike against Iran. Iran threatened to fight back, causing extreme panic in the market. Funds flowed into the gold market for safety. After breaking through the 3,400 mark, the gold price rose steadily, reaching a weekly high of 3,446. Later, it retreated and held steady above the 3,400 mark. On the daily chart, it closed above 3,400 for the first time.

Looking ahead to this week, the escalating geopolitical situation will still provide support for gold prices. In the middle of the week, the Federal Reserve will hold an interest rate meeting. It is expected that the interest rate will remain unchanged, but the statement after the meeting will offer some insights into the direction of interest rates in the second half of the year, which requires close attention. Let's take a look at the market situation. You might as well refer to each other.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram