"dollar smile" holds the key to market changes

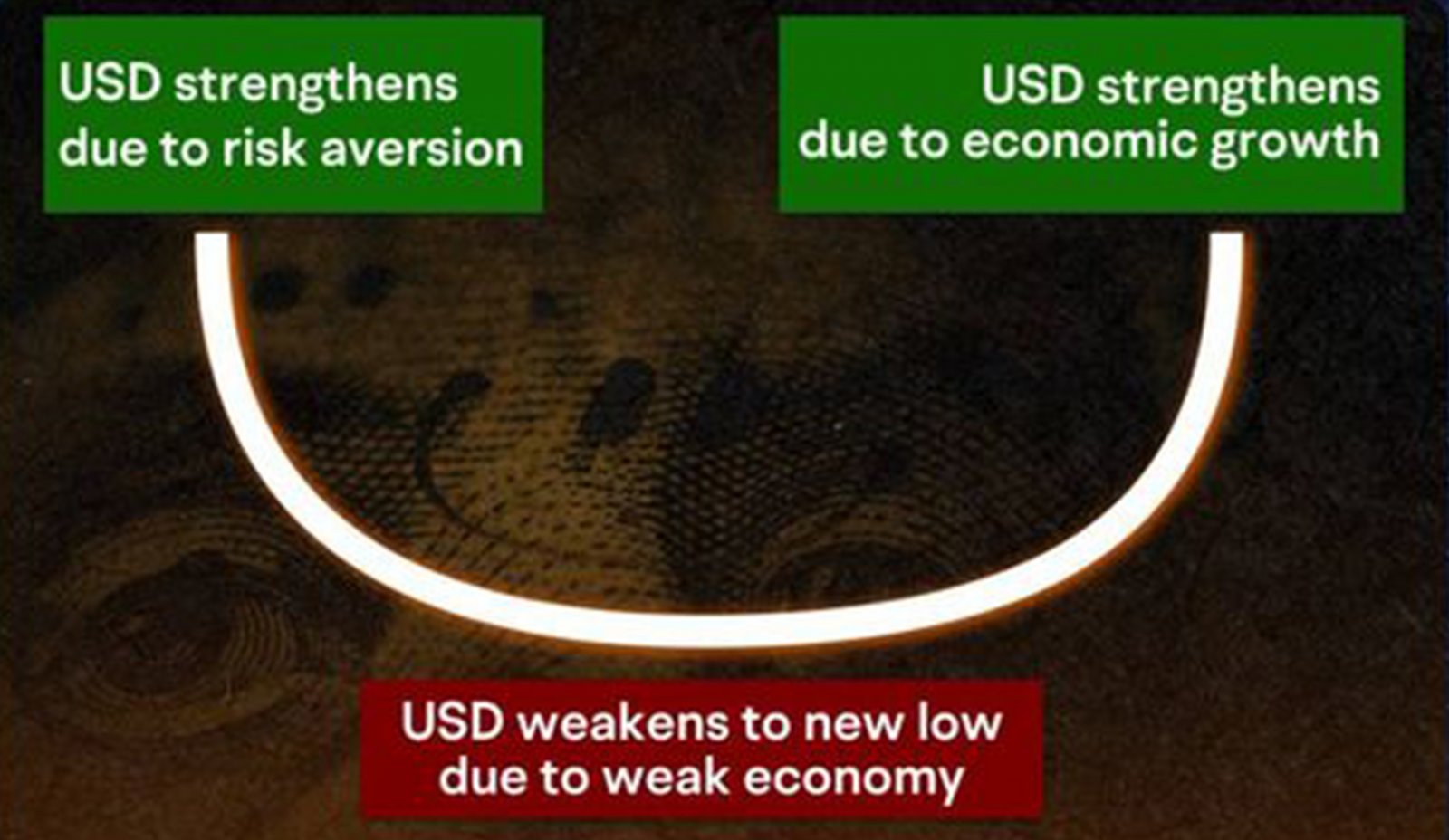

The "dollar smile" was put forward by Stephen Jen, a well-known economist, who described the trend of the dollar as a smiling face curve, which showed the performance of the dollar exchange rate under three different economic conditions:

The American economy is strong: when the American economy performs well and grows strongly, investors will invest money in the United States and buy dollar assets, and then the dollar will appreciate, which is the right rising part of the smile curve.

Global economic instability: When there are problems or uncertainties in the global economy, investors will turn their money to the safe currency, the US dollar, to preserve value and avoid risks. At this time, the dollar will also appreciate, which is the left rising part of the smile curve.

Economic stability or slowdown: when the economy does not grow significantly or slows down slightly, investors' demand for US dollars decreases and may choose to invest elsewhere. At this time, the US dollar will depreciate, which corresponds to the middle concave part of the smile curve.

Investment strategy when the dollar is strong;

Strong economy: When the US economy grows strongly and the data is bright, the US dollar usually strengthens. At this time, investors will consider increasing the allocation of US assets, such as US stocks or bonds. Because economic growth means that corporate profits increase, the market performance may be better.

Demand for safe haven rises: When the global economy is unstable or facing crisis, the US dollar will strengthen as a safe haven currency. At this time, investors can increase their holdings of assets denominated in dollars or dollars, such as gold, because such assets are more defensive when the market fluctuates.

Investment strategy when the dollar weakens;

Steady or Slow Economic Growth: When the US economy grows steadily or slightly, and the US dollar may weaken, investors can consider investing in assets of emerging markets or other countries because the growth potential of these markets may be higher than that of the US, and the chances of currency appreciation are greater.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram