Buffett Index Find the Bubble Signal! ?

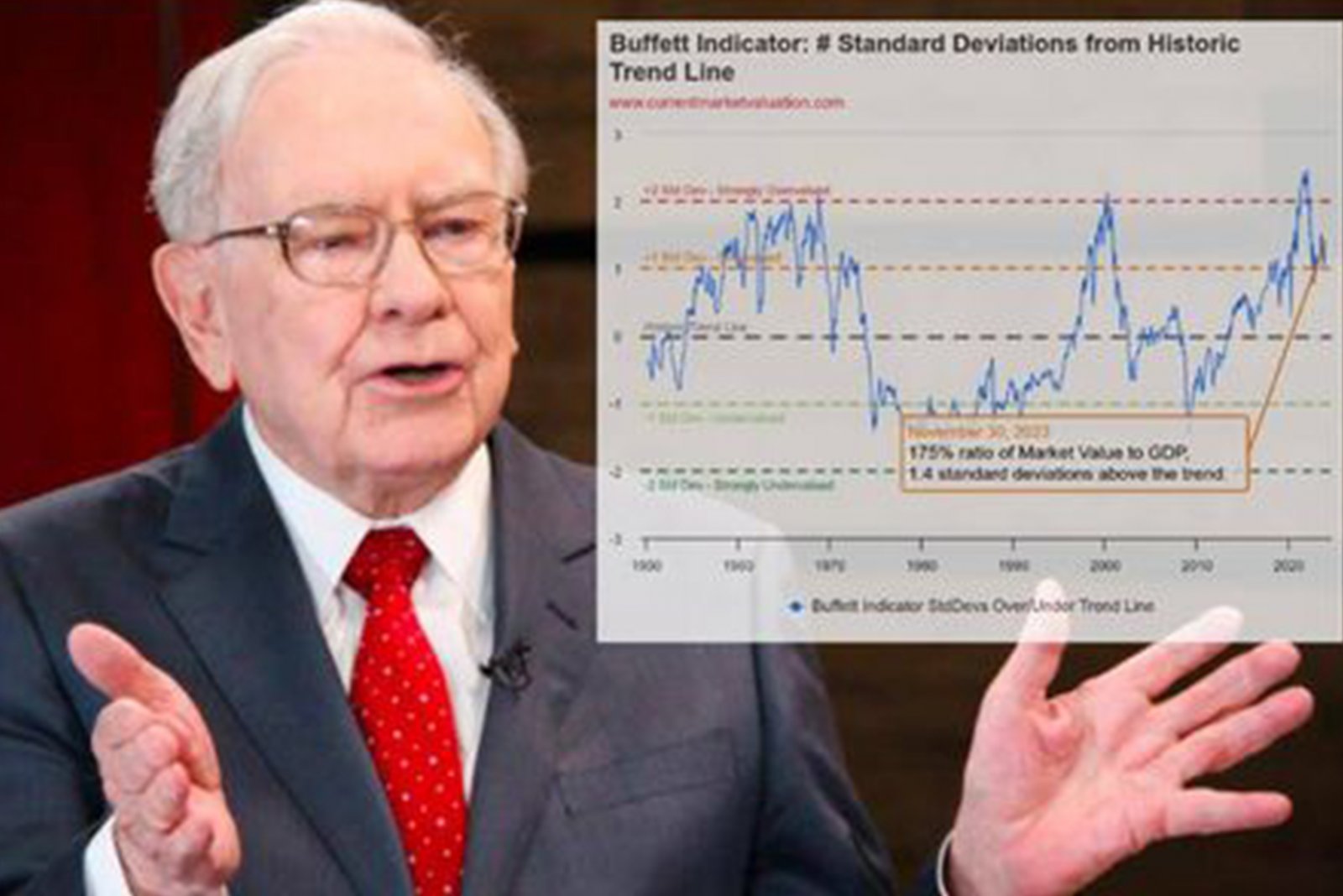

Buffett Indicator was put forward by the famous investor Buffett in 2001, claiming to be the best single indicator to measure the stock market valuation at any time. It is a percentage obtained from the total market value, gross national product (GNP) or gross domestic product (GDP), which can judge whether the stock market is overvalued or undervalued, and is applicable to stock markets everywhere.

GDP and GNP

Take the United States as an example, the difference between GDP and GNP is that GDP means that as long as all the output is counted in the United States; As for GNP, Americans will be counted if they produce abroad. However, because the actual difference between GDP and GNP is within 1%, the mainstream market usually uses GDP to calculate later.

Five grades of ratio:

Buffett indicator 100% represents a reasonable valuation of US stocks.

Buying stocks at 70% or 80% may have a good return.

114% to 134% is slightly overestimated.

More than 134% is a serious overestimation.

Buying stocks at 200% is like playing with fire.

What is the latest Buffett indicator?

The Buffett Index broke through 200% in August 2021 and rose to a high level at the end of the year. It began to decline in 2022, with a low of about 150% during the year, and rose again in 2023. Recently, it rose to more than 170% to 180%, which was more than 50% higher than the historical trend level, and it was about 171% as of January 2024, reflecting that the US stock market was seriously overheated.

Buffett indicator is questioned.

In addition to the delay in GDP data, non-stock assets, such as bonds, real estate and gold, have not been assessed.

More people question that it is out of date. When Buffett's index was first published, many constituent companies were in manufacturing, retail and energy industries. Today, the largest companies in the United States are in science and technology industries. At present, the price of the stock market fully reflects internationalization, but GDP only evaluates the production in the United States, causing the numerator (total market value) to rise, while the denominator (GDP) is not affected.

How should investors use it?

Buffett indicator can be used as a supplementary valuation tool, and it is also one of many emotional indicators in the market today. Others, such as VIX volatility, fear and greed index, are more used not as a tool to find trading opportunities, but to tell you the market situation and future expectations, and use it to predict whether the market is overvalued.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram