Head and shoulder shape inversion breakthrough signal

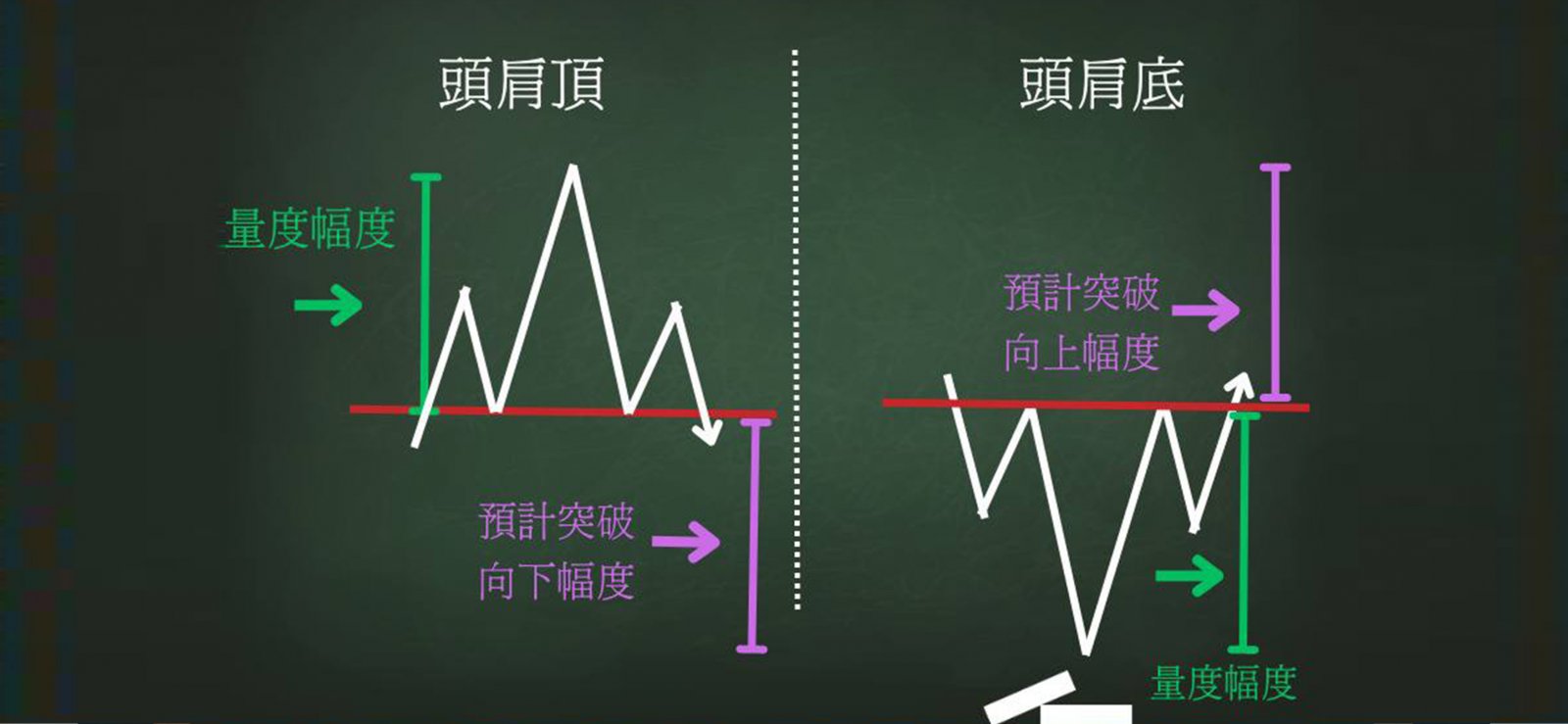

Head-and-shoulder shape appears most in the chart shape, because both sides have been wrestling for a long time and the momentum of one side has gradually become clear, so it is a reliable reversal breakthrough shape. There are two types: head and shoulder top and head and shoulder bottom.

head & shoulders top

It consists of three different tops: the left shoulder, the head and the right shoulder, and the supporting position is connected in a line to form the neckline. The left shoulder has the largest turnover, followed by the head, and the right shoulder is thinner. When the price falls below the neckline, there will generally be a sharp and large decline.

head andshoulders bottom

It is the inversion of the top of the head and shoulders, and consists of three different bottoms: the left shoulder, the head and the right shoulder. The resistance position is connected into a straight line, which is the neckline. When the price rises above the neckline, there will generally be a strong increase.

The vertical distance from the head to the neckline measures one to three times the height of the increase/decrease after the breakthrough.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram