Predict the pace of raising interest rates! What is the FED bitmap?

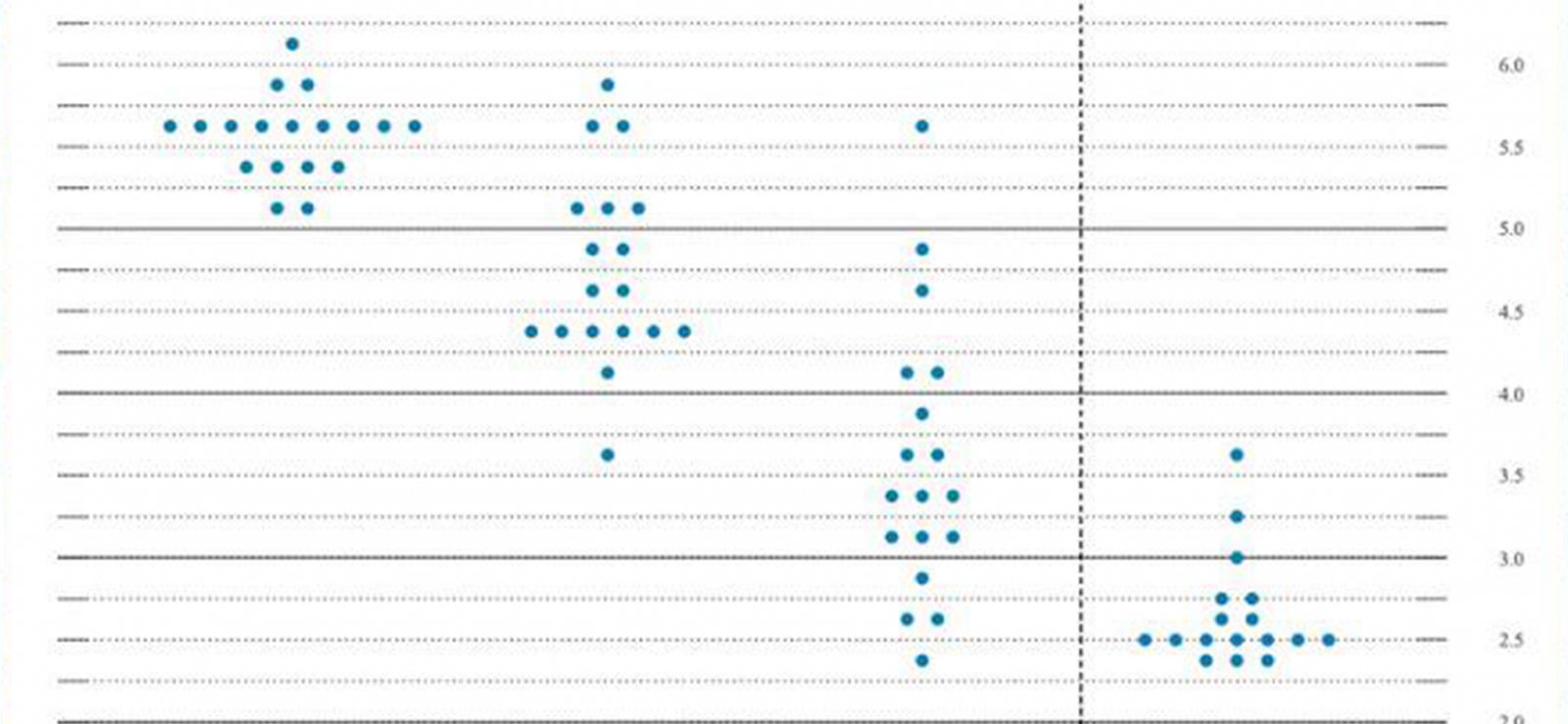

The Federal Reserve will publish the latest bitmap and economic forecast after the interest rate discussion, and the market often uses bitmap to predict the pace of interest rate increase.

What exactly is a bitmap?

Each point in the bitmap represents a central bank governor's prediction of short-term interest rates. If the economy develops according to the expected path, the federal benchmark interest rate will be average in the next three years.

Members will also provide a reference for the long-term interest rate, which stands for the so-called "neutral interest rate". The neutral interest rate represents the point where interest rates will neither stimulate economic development nor limit economic growth.

The bitmap can let us know where the largest distribution is and FOMC members' views on the interest rate trend in the next few years, so that the market can bring enlightenment to the future interest rate.

There are blind spots in bitmap.

These points are anonymous, and no one knows which member is which point. In addition, the Federal Reserve rotates voting members every year, so not all members have the right to vote, so it is impossible to judge from the bitmap.

Assuming that most members think that the interest rate will rise to a higher range, but they do not have the right to vote, and those members who have the right to vote are not expected to be so radical, the final result of interest rate discussion is likely to be more conservative.

Attention of investors

The market is changing rapidly, and people's expectations will change quickly. In addition, the bitmap is not a promise. With the change of economy and the development of financial market, the interest rate forecast will change at any time.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram