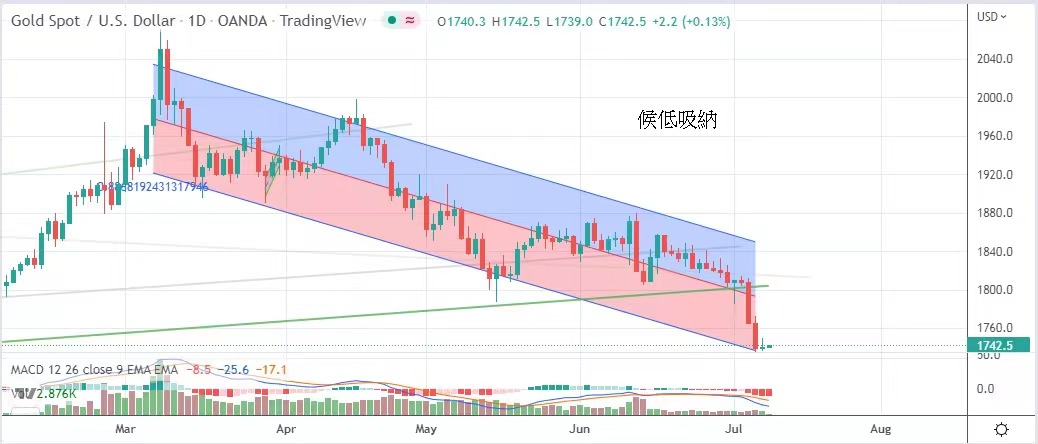

Waiting for low absorption

July 8th

Today's amplitude range

The European Central Bank's intention to raise interest rates early is obvious, which narrows the expectation of the spread with the US dollar, and the US dollar index shows signs of peaking. Two Fed officials supported a further rate hike of 0.75%,

And said that the fear of the US recession was exaggerated by the market. The market is concerned about the release of U.S. non-farm payrolls data tonight. Federal Reserve Governor Waller expects that the U.S. non-farm payrolls report will record

An increase of 275,000 people is more optimistic than the market expected. At present, the short position in the gold market is still dominant, but once the gold price falls below $1,730, it is attractive enough to wait for low absorption. now

Suggested daily volatility is $1,733 to $1,753.

The government announced that it would suspend the fuse mechanism of individual routes from now on. In fact, this mechanism lost its meaning when the The 5th Wave epidemic broke out in Hong Kong last year, and instead became a nuisance to the people.

It also increases the social cost and scares businesses; Hong Kong stocks rose to express their welcome to this policy. The Hang Seng Index opened 233 points lower, with a maximum drop of nearly 400 points, after which investors took advantage of the low price.

People, the Hang Seng Index finally closed at the highest level of 21,643 points in the whole day, up 56 points or 0.26%. Hong Kong stocks rose yesterday, and the market turnover shrank to only HK$ 112 billion. The market outlook should still fluctuate.

Three major European stock markets rose for two consecutive days.

The minutes of the meeting of the Governing Council of the European Central Bank further provide the trend of raising interest rates. In its agenda, it shows that the upward risk of inflation in Europe has increased, and a small number of members expect a larger increase.

To suppress the price increase, we must avoid any idea that "gradual rate increase" means that the rate increase will not exceed 0.25. The European Central Bank's intention to raise interest rates early

Obviously, but the range is still moderate compared with that of the United States. The three major European stock markets rose for two consecutive days, and the German DAX index rose by 1.96%; Paris CAC index rose by 1.59%; British wealth

At 100, the index rose by 1.11%.

Two Fed officials supported the continued interest rate hike, but said the US economy had a chance to make a soft landing. Waller, the governor of the Federal Reserve, made a speech, saying that the bureau was determined to control inflation by actively raising interest rates.

Admittedly, raising interest rates does incur the risk of some economic losses, but if the U.S. economy can reduce its growth rate within nine months to one year, it will be enough to avoid causing recession.

Let inflation fall. Brad, another official, said that the 75-point interest rate increase in July was significant, but he didn't think that there was an economic recession as a result. He explained that some people mistakenly put

The slowdown in growth is regarded as a recession, implying that the economy will not collapse because of the interest rate hike. Therefore, he still supports the Federal Reserve's continued interest rate hike this year, and expects that as long as the federal funds rate rises to 3.5%, it can

Seeing that prices are stable again, the Federal Reserve can adjust its policies, including the possibility of cutting interest rates.

The number of initial jobless claims in the United States rose unexpectedly last week, with a data of 235,000. Nevertheless, the Federal Reserve Governor Waller expressed his optimism about the US labor market, expecting that the United States would be non-agricultural.

The report will record an increase of about 275,000 people, reiterating that the fear of the US recession has been exaggerated by the market. Another official, Federal Reserve Brad, also said that the market will grow by mistake.

As a slowdown. Two Fed officials' positive views on the U.S. economy supported the rise of the stock market, with the three major Wall Street indexes rising across the board, with the Dow Jones index rising by 1.12%; General standard

The Er 500 index rose by 1.48%; The Nasdaq Composite Index rose 2.28%.

The minutes of the meeting of the European Central Bank's management committee show that the three conditions of the guideline for raising interest rates have been met, and the central bank's intention to raise interest rates early is obvious, which has narrowed the interest rate spread with the US dollar; US dollar index from

The fall in the high level, coupled with the unexpected increase in the number of initial jobless claims in the United States last week, contributed to the rebound of the gold price. The lowest gold price ever reached $1,736.6 and the highest reached $1,749.1, but the Federal Reserve

The two officials supported a further interest rate increase of 0.75% and remained optimistic about the economic environment after the rate increase, which suppressed the momentum of gold price growth. The increase of gold price narrowed to 0.9 USD, closing at the newspaper.

$140.3.

For detailed analysis and operation suggestions, please CLICK the following link to join the group and ask the administrator.

https://t.me/mingtak

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram