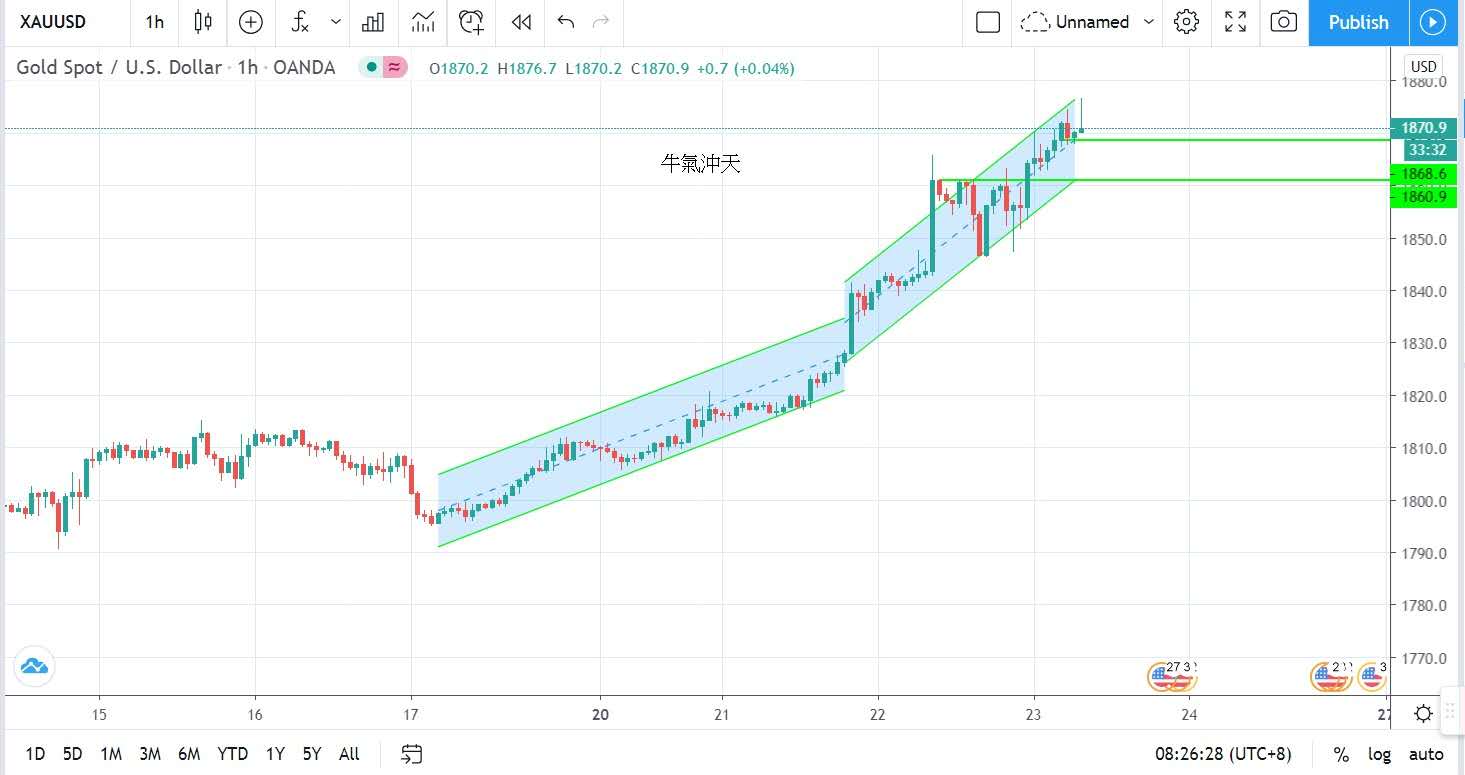

Full of funds

Sino-US relations have worsened, and the United States has ordered China to close its embassy in Houston within 72 hours. The United States accuses China of using its embassy to collect information about American nationals and stealing high-tech information from the United States.

Coincidentally, there was a fire in the embassy, which was suspected of burning the evidence. China responded immediately, accusing the United States of falsifying the facts and completely tearing up the diplomatic relations established for many years, expecting the United States to correct them.

On the other hand, the meeting between US Secretary of State Pompeo and British Prime Minister Johnson not only discussed the strengthening of business cooperation between the two countries, but also involved China's ambitions, such as Huawei, and repeatedly mentioned the autonomy of Hong Kong.

It is an inevitable fact that China is isolated by western countries. Although the dream of becoming a brother in the world is magnificent, it is fraught with obstacles! Following the successful coordination of the "Recovery Fund of 750 billion euros" among the 27 EU countries,

To relieve the impact of new viruses and revitalize the euro zone economy. The market is spreading that the United States has to take relief measures for enterprises and people all over the country again in response to the epidemic.

The first round of stimulus measures in the United States amounted to US$ 2 trillion, while experts estimated that the new bail-out measures needed about US$ 1.5 trillion to stimulate the weak US economy.

This estimate is hundreds of billions of dollars more than many congressmen expected. No matter how much money the US Congress will approve this time, it is almost certain that the Federal Reserve will keep the interest rate at the current level.

That is, in the range of 0 to 0.25 pct. The bolder assumption is that there will be a third or even more bail-out measures. Funds are filled in the investment market, the dollar hedging function declines, and the dollar index continues to fall, only reaching above 95.

When the gold price opened in Asia, it was bullish, reaching $1,865.8, breaking the high level this year first. During the US market, it rose by relay due to geopolitical tensions, and closed at the highest level of $1,872 per ounce yesterday, with a fluctuation of nearly $31 yesterday.

Yesterday, the United States announced last week's crude oil inventories, which reported a big increase of 4.9 million barrels, which was worse than the expected decrease of 2 million barrels in the market. In addition, the oil price fell in a narrow range due to the continued bad relations between China and the United States. New york oil futures closed at $41.9 a barrel, down slightly by 2 cents.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/joinchat/OEEaFRx9QcbOZE-aQzNSgg

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram