Achievements

After a marathon meeting in Brussels for four days, the leaders of the 27 EU countries made efforts to coordinate the distribution of the "recovery fund of 750 billion euros" in various ways, and finally achieved results.

All agreed to reduce the initial plan from 500 billion grants to 390 billion euros, while the low-interest loans increased from 250 billion euros to 360 billion euros.

At the same time, the meeting also approved the 1 trillion euro budget for the next seven years, and the condition attached to this budget is that the EU has the right to prevent countries that violate the so-called "rule of law" from receiving relief funds.

Compared with this clause, countries that are pro-CCP, including Poland and Hungary, first threatened to oppose it, and finally made compromises on the premise of their own interests. Stimulated by the news of the Recovery Fund,

Major stock markets in the euro zone rose in an all-round way, among which Germany's stock market performed best, and Germany's DAX index closed up about 1%, the highest in five months. The rest generally increased by 0.2% to 0.5%. The FTSE 100 Index also rose by more than 0.1%.

Benefiting from the vaccine effect of COVID-19, coupled with the optimistic outlook of liquidity; The new funds that have been formed in the euro zone, and the market is spreading, the United States has to take relief measures for enterprises and people all over the country again in response to the development of the epidemic.

Yesterday, the global stock market was hot. The Dow Jones index once broke through the level of 27,000 points and finally closed at 26,840 points, up 0.6%. Oil prices rose sharply yesterday, driven by vaccine progress and the expectation of EU recovery fund.

Although the cumulative number of infected people in novel coronavirus exceeded 4 million yesterday, investors are not afraid that many countries will tighten epidemic prevention measures and geopolitical tensions again, and continue to focus on the optimistic economic prospects.

New york oil futures closed at $41.96 per barrel, up $1.15 or 2.8%. Gold has also performed well. Affected by the epidemic, the market expects central banks of various countries to continuously increase fiscal stimulus, and the stock market is hot.

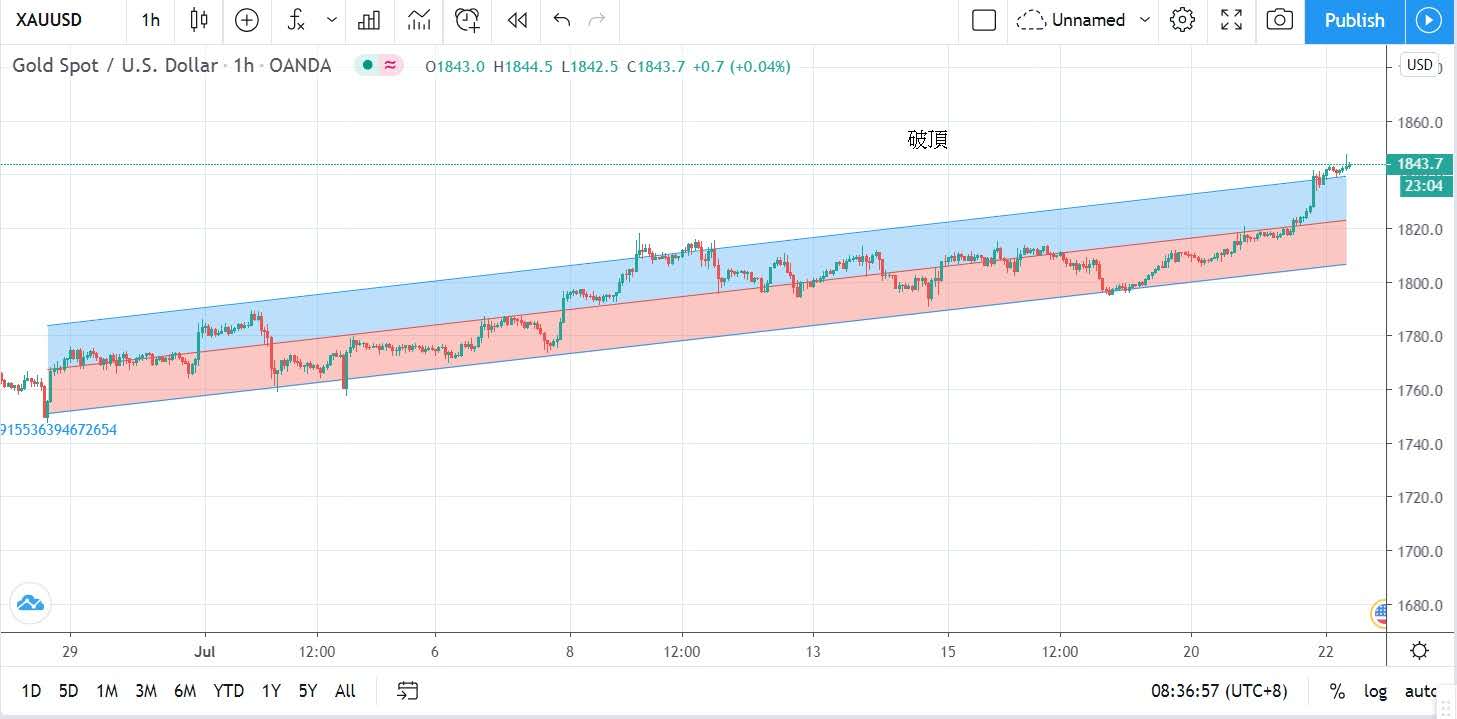

The weakening of the U.S. dollar index led to the rise of gold price, which hit a new high in more than eight years yesterday. It rose repeatedly during the opening hours in Asia, and when it broke through 1,825 dollars, it broke through 1,840 dollars and reached the highest level of 1,843.5 dollars.

It closed at $1,842 per ounce, up $25, or 1.3%.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator

https://t.me/joinchat/OEEaFRx9QcbOZE-aQzNSgg

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram