Same pace.

On October 13th.

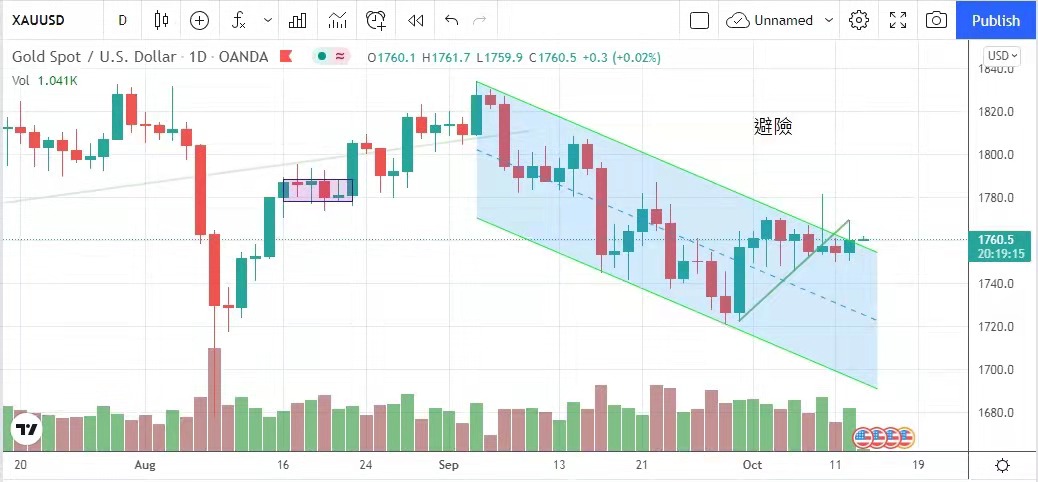

Today's volatility range:

Although the voice of the Federal Reserve's delisting sang loudly, the employment data of the United States repeatedly showed month after month, adding uncertainties. In Bostic's speech last night, the Federal Reserve said that inflation was indeed higher than the Committee's target of 2%.

However, the Fed is still satisfied with the volatility of inflation at present, and the market is running well and the liquidity is sufficient. He predicted that reducing the scale of bond purchase would not have a negative impact, and the current soaring inflation is not enough to change the prospect of the Fed's interest rate hike.

It is expected that the rate hike will be more than one year later. It implies that the pace of water collection by the Federal Reserve will not change, and the current situation of gold price seems to have reflected the policy that the water collection by the Federal Reserve will be locked in November, but is this really the case? There will be an American federal open market at 2: 00 tomorrow morning.

Minutes of the Committee, goodbye to the real chapter.

New york oil futures stabilized at $80 per barrel, and the global energy shortage threatened the economic prospects. European and American stock markets fell, and funds turned to gold and dollar assets to avoid risks. The US dollar index rose to 94.56 points, climbing to.

One-year high, but this does not hinder the rise of gold price. Yesterday, the gold price was as low as $1,751 and as high as $1,769, and closed at $1,760, up $6. The gold market will continue to fluctuate, and today's suggested volatility is between 1748 and 1768 dollars.

Yesterday, it was said that mainland departments and media had not made any negative comments on related industries of Kewang in the near future, but yesterday, they were beaten in the face, and the market spread to the mainland to examine the relationship between the financial industry and regulators and private enterprises such as China Evergrande, so as to investigate whether there was any corruption.

In addition, apart from the above-mentioned financial institutions and indoor enterprises, the respondents also include the giant companies in contact with the regulatory authorities, such as Ant Group and Didi, etc., and whether the key personnel in charge of supervision will have high-level relations with private enterprises.

Too good, which affects the efficiency of supervision or whether there are any irregularities in the middle. The tangible hand of the mainland once again successfully intervened in the market, Hong Kong stocks ended three consecutive rises, and the science and technology index closed down more than 3%; The Hang Seng Index fell below the 25,000 mark,

Closing down 1.43%.

According to the International Monetary Fund, the global economic growth this year has been lowered due to the emergence of the COVID-19 strain in the world, and the longer-lasting inflationary pressure caused by the supply bottleneck, which increases the risk of economic recovery and growth.

0.1 to 5.9%. In addition, the economic prosperity index industry in the euro zone fell sharply, which affected the market investment climate. The three major European stock markets fell, and the DAX index in Germany and CAC index in Paris, France also fell by 0.34%. Britain's FTSE 100 index fell 0.23%.

US stocks fell for three consecutive days. The International Monetary Fund lowered the gross national product (GNP) of the United States this year, from an earlier forecast growth of 7% to a forecast growth of 6%, which is in the same pace as the forecast made by well-known investment banks in the United States a few days ago.

The forecast of economic slowdown makes the risk market more pessimistic, with the three Wall Street indexes falling, and the Dow Jones index falling by 0.34%. The S&P 500 index fell 0.25%; Nasdaq index fell 0.14%.

In Bostic's speech last night, the Federal Reserve said that the inflation rate was indeed higher than the Committee's target of 2%, but the Fed was still satisfied with the current volatility of inflation, and the market was running well and the liquidity was sufficient, so he expected to reduce purchases.

The scale of debt will not have a negative impact, and the current soaring inflation is not enough to change the prospect of the Fed's interest rate hike. He personally expects that the interest rate hike will be more than one year later. Implies that the Fed's water collection pace will not change. New york oil futures stabilized at $80 per barrel,

The tight global energy supply threatens the economic prospects and aggravates inflation concerns. European and American stock markets have fallen, and funds have turned to gold and US dollar assets to avoid risks. The US dollar index rose to 94.56 points, reaching a one-year high, but this did not hinder the rise of gold prices.

Yesterday, the gold price was as low as $1,751 and as high as $1,769, and closed at $1,760, up $6.

For detailed analysis and operational suggestions, please CLICK the following link to join the group and check with the administrator.

https://t.me/mingtakchat

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram