The cooling of inflation will help to cut interest rates, and the price of gold will stop and then rise.

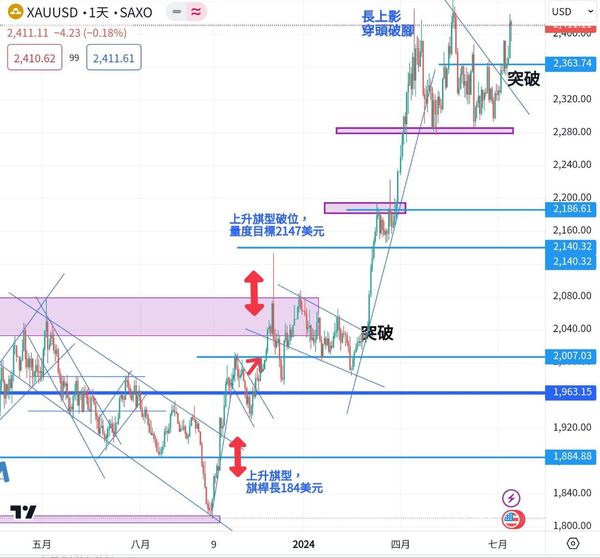

At the beginning of last week, the price of gold did not accept the earlier uptrend, and some time ago, the price retreated and swallowed up all the gains brought by the non-agricultural night last week. However, the price of gold softened to 2350, which was supported. After the last breakthrough of 2357 at the top of swing, the resistance became supportive. After once falling below 2350, buying quickly emerged, which continued the good tone of the price of gold and made the uptrend healthier after the retreat.

On the one hand, Federal Reserve Chairman Powell said that cutting interest rates too early would rekindle inflation, but on the other hand, he also said that keeping interest rates at this high level for a long time would hinder economic growth. It was confirmed that the interest rate reduction cycle was very close, and interest rates would be cut as soon as inflation began to fall. After the middle of the week, inflation really cooled down, and CPI was as low as 3%, which was lower than expected. In addition, the confusion of worrying about the rebound of inflation was cleared up in the middle of the year.

The Federal Reserve's expectation to cut interest rates in September rose sharply to 75%, and some market participants expected to cut interest rates again in December. The price of gold surged forward, breaking through the 2400 mark and heading for a historical high again. Although the PPI rebounded on Friday night, the price of gold continued to stabilize at the 2400 mark, and each fall was limited to retreat and then stabilized again.

Looking ahead to this week, there are not many economic data. The more important ones are the US retail sales and the European Central Bank's interest rate cut. The market is likely to continue to digest the US interest rate cut space in September and support the gold price to stabilize. However, whether it can break through the historical high of 2450 is the key to the continuation of the uptrend. The market situation is not good. Let's refer to each other.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram