Serial move

August 30th.

Today's amplitude interval

This week is the American Super Data Week, and a number of important data will be announced soon, including the core consumer price index of the United States, which the Federal Reserve is particularly concerned about.

Yesterday's consumer confidence index of the American Consulting Chamber and the number of job vacancies for migrant workers in the United States were both lower than expected, and the data made investors look forward to it.

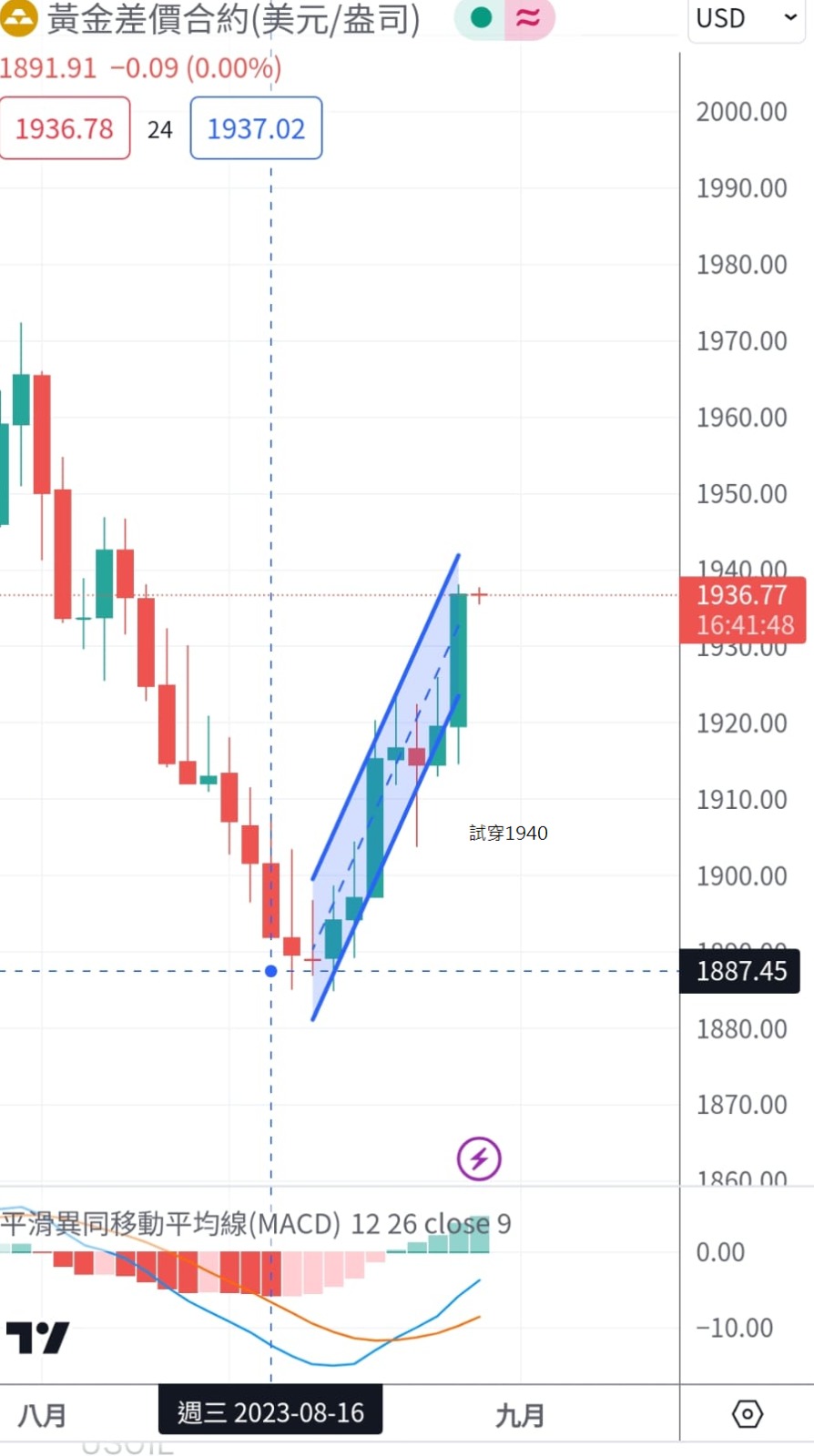

The Reserve Bank may postpone the rate hike. The gold price is looking for a new direction after returning to the 200 antenna, so it is advisable to control the betting. Today's suggested volatility is between 1920 and.

1945 dollars.

The mainland stock market lowered the stamp duty on shares from yesterday. For investors, it is certainly a good thing to reduce the investment cost, but ultimately it depends on the economic prospects.

And profit opportunities; On Monday, Hong Kong stocks soared by 600 points. However, the upward trend could not be sustained. Yesterday, mainland banks were told to reduce interest rates and deposit requirements.

Reserve funds, Hong Kong's stock market and the mainland market are well established. After the Hang Seng Index opened 130 points higher, the increase continued to expand, reaching a maximum of 453 points and closing at 353 points.

18484 points. The mainland has repeatedly overspent to save financial markets, boosting investor confidence, and European stocks have followed the trend of Asian stock markets, opening higher and closing higher.

On the other hand, this week is the American Super Data Week, and many important data will be announced soon, including the core personal consumption of the United States, which the Federal Reserve is particularly concerned about.

Price index, the data is enough to affect the speed of the Fed's interest rate hike. The three major European stock markets rose across the board, with Germany's DAX index rising 0.88% and Paris, France.

The CAC index rose by 0.67%, while the FTSE 100 index rose by 1.72%.

Powell made a speech at the annual meeting of global central banks in Jackson Hole. The Federal Reserve is prepared to raise interest rates further at an appropriate time, implying that it will discuss interest rates before the end of the year.

There is still an opportunity to raise interest rates in the meeting, but the weak US economic data released yesterday will help delay the Fed's interest rate hike policy, and the three major stock indexes on Wall Street will be across the board.

Up, the Dow Jones index rose 0.58%, the Standard & Poor's 500 index rose 1.13%, and the Nasdaq Composite Index rose 1.54%. American consultation announced yesterday

The consumer confidence index and the number of vacancies for labor mobility in the United States were lower than expected. In addition, China repeatedly made moves to support the market, and the dollar weakened, following the gold market.

Continued to fluctuate upward, the highest price of gold was $1,938.1, and the lowest price was $1,914.6, closing at $1,936.9, rising to $17.8.

For detailed analysis and operation suggestions, please CLICK the following link to join the group and ask the administrator.

https://t.me/mingtak

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram