The dollar index affects the global market index! ?

What is the dollar index?

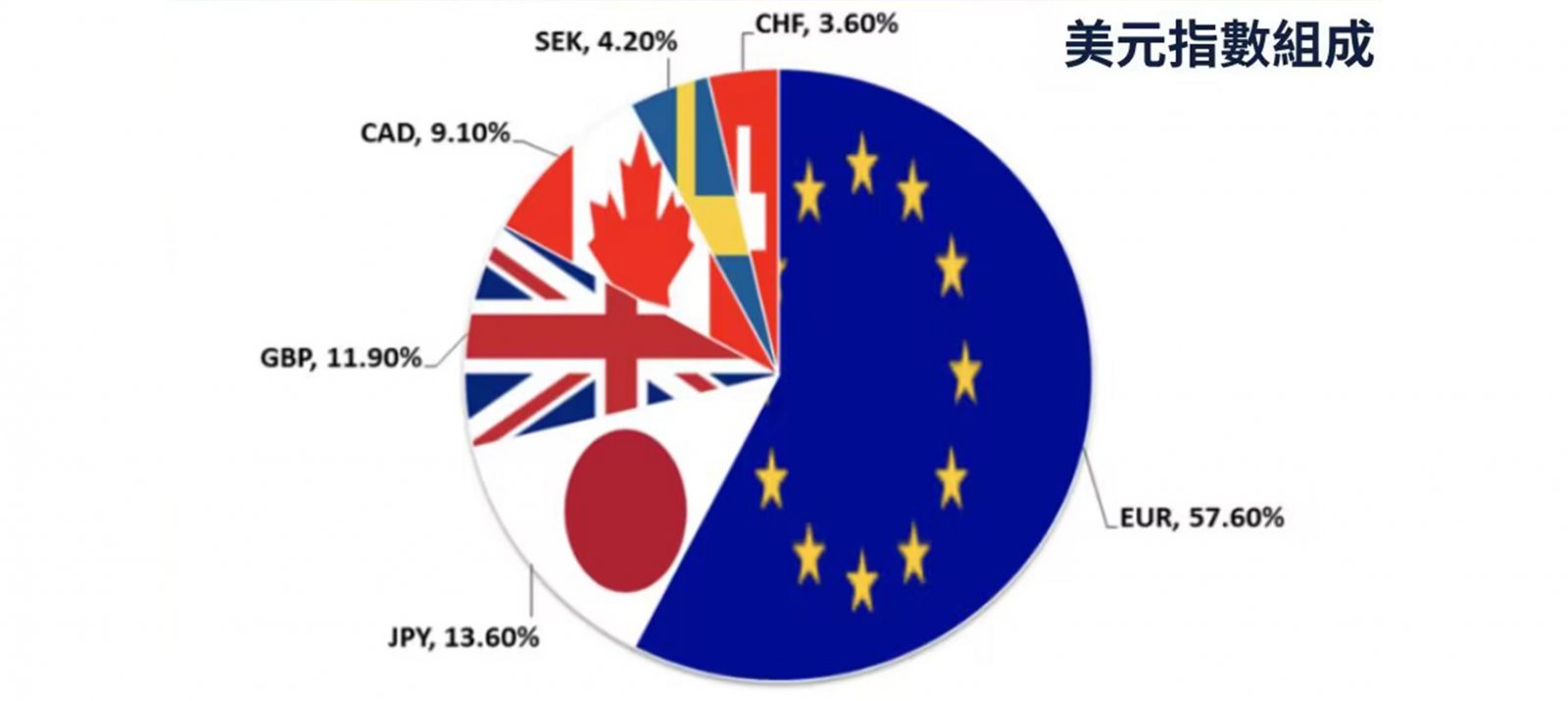

The US Dollar Index, DXY) is an indicator to observe the trend of the US dollar against the world currencies, and the exchange rate of the US dollar against other major currencies in the world is used as an indicator to calculate. It can reflect the strength of the dollar itself.

How to interpret the dollar index?

The value of the US dollar index is not the price of the US dollar, nor the exchange rate, but the degree of rise and fall relative to the base of 100. Assuming that it rises from 100 to 120, it means that the US dollar has appreciated by 20% relative to the six currencies during this period, which means that the US dollar index has strengthened. And vice versa.

How to affect the global market?

International trade price

At present, the US dollar is a global currency, and most international commodity transactions need to be bought and sold in US dollars, including gold and crude oil. Therefore, the trend of the US dollar also affects the prices of gold, crude oil and dollar-denominated trade commodities.

Affect the exchange rate of various countries

When countries exchange money, they often change it into dollars first and then into dollars. From the change of the US dollar index, we can also quickly see the changes of other countries relative to the US dollar.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram