Is there a way to be financially free?

Every day, I live in financial freedom. Every morning, I wake up naturally. Every day, I live the life I want. Everyone yearns for it, but when I study, there is no subject called financial management, which is lacking.

Some financial concepts, in fact, it's hard to get to the road of self-financing. Today, I'd like to share with you the concept of asset allocation. Financial management is basically to balance income with expenditure, but to achieve wealth.

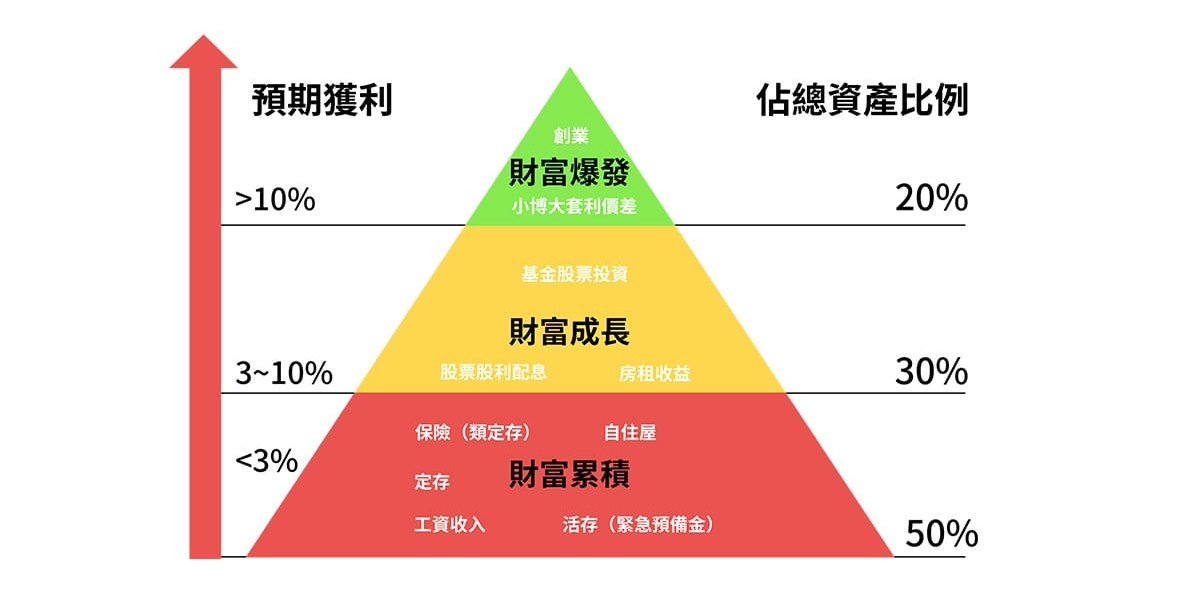

To accumulate, we must learn to understand the financial pyramid. The pyramid concept is that the base should be stable, and the top should be light and the bottom heavy, so that it can be stable and upward.

Divide your income into 50%, 30% and 20%. 50% is to meet living expenses and urgent needs, and there is always a need for living expenses, so this distribution should not take too much risk, and

And the liquidity should be high, such as food, transportation and other expenses and spare cash. These basic expenses are to maintain the living. If the income is high, some of them can be put into time deposit or savings insurance.

And other assets with high liquidity. When the base is laid, then comes the part of how to increase the value of assets. Just like a team, the base is the back defense, and we still have the middle.

And the striker to win the game, 30% of the capital allocation is the midfield position.

30% is an offensive and defensible configuration, and its main purpose is to catch up with inflation. Because if all income is used for expenses, your purchasing power will only be eroded continuously during inflation.

But on the other hand, you should not go too far, otherwise you will take too much risk. In case of economic downturn, you will lose your income by being laid off, and you will lose your funds and get your expenses again. This category can arrange bases.

Or high-interest public shares, which can catch up with inflation and stabilize dividend distribution without losing liquidity.

The last 20% is the key to getting rich. 20% need to allocate a possibility of wealth explosion. It's like a sailboat. You just have to get the bottom of the boat, but you can't get out without sailing.

Dear, when the economy takes off, you have to sail to fly high in the wind. If you have a long way to go, you have to have enough space for the sail. Many people often don't sail because they are afraid of risks, and as a result, when

However, you can only watch other ships sail away and stay where you are, and you will never get on the road of financial freedom. This kind of configuration can be leveraged products, or start-ups, etc., which can be used in small

A big explosive tool for fighting. This kind of configuration is not much, but it cannot be done without.

Through the financial pyramid, you can allocate your funds more effectively. Even if you have never learned financial wisdom, you can beat the market by accumulating and creating wealth in this way.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram