Russia's Central Bank Stopped Buying Gold

The Russian Central Bank suddenly announced yesterday that it would stop buying 1/4 of its domestic gold production. As a result of the news, the gold price eased back to a week-low level and reported its recent increase.

In addition, US President Trump's plan to push back the pound infrastructure plan and invest in infrastructure also supported the trend of the US dollar. The US dollar has continued to rebound this week. Although the tight liquidity in the market seems to have come to an end,

However, there is still a need for hedging in market sentiment, which has stimulated investors' demand for US dollars. Gold itself has also been boosted by its hedging function. However, the Russian Central Bank said earlier that it will no longer buy domestically produced gold.

As a result, the price of gold rose feebly and lost the US$ 1,600 mark in the evening. The price of gold was almost in place at a minimum of US$ 1,569. Tonight, the United States will announce ADP private jobs commonly known as small non-agricultural jobs.

We can pay attention to the performance of the labor market and observe the current economic situation in the United States. Gold prices have the opportunity to further decline and find support below before they can climb again.

Russia's central bank is currently the world's largest buyer of gold. The decision to stop buying gold has not been explained. It is only said that this is a decision made by the country after examining its financial situation. In the past few years in Russia,

He has been increasing his gold reserve as a human resource. By the end of February, his gold reserve had reached 2279.2 tons, ranking fifth in the world with a value of 114 billion US dollars. The reserve level was quite high.

The central bank bought 158.1 tons of gold last year. It is estimated that the gold reserve accounts for a high proportion of the country's overall level. In addition, the rise in gold prices in the past two years has caused Russia to suspend its purchase plan. Although the central bank has reduced its holdings,

However, the market demand for gold is very high. Gold ETF recorded its largest capital inflow in nearly 10 years. Last week, some ETF funds recorded an inflow of nearly 3 billion US dollars, the largest inflow since 2009.

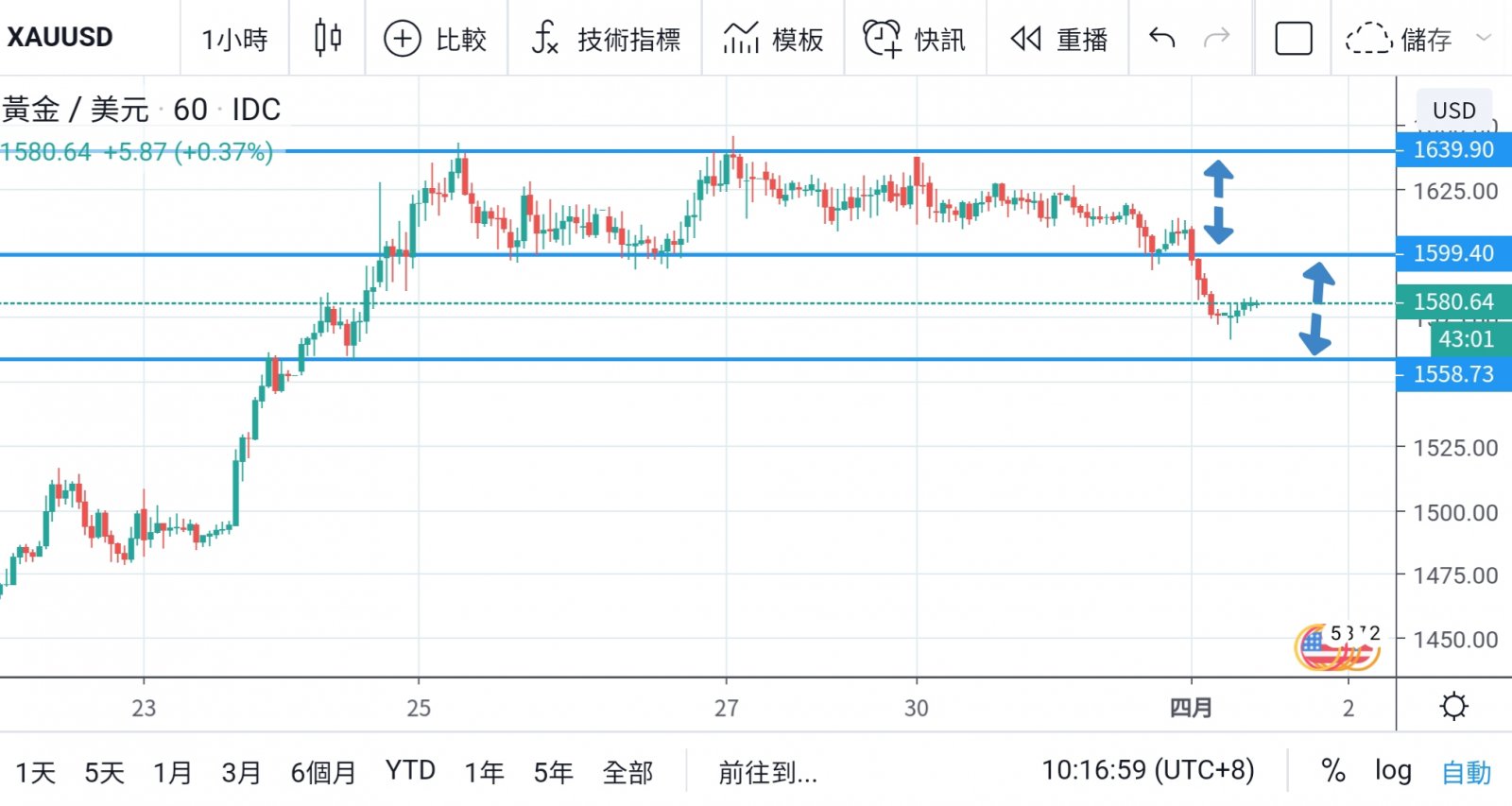

Technically, the gold price has lost its earlier consolidation range, and there will be a short-term weak spot. It is expected that the gold price will not rebound back to the 1600 mark. Gold prices generally consolidated between 1595 and 1630 last week.

At present, the trading range is lost, and the calculation adjustment range can reach 1,570 US dollars. Although gold price has hit this position for a time, the bottom may not stabilize immediately. Therefore, there is still a chance to hit this level again and then consolidate again.

U.S. President Trump's introduction of another heavy-pound infrastructure rescue measure will also give a strong shot in the arm to market confidence, thus reducing the demand for safe haven in the market. Gold price, that is, the market trend, is not too optimistic.

U.S. will announce ADP job growth tonight, which is expected to record negative growth. However, if the figure is too frightening, it may increase the market's demand for safe haven against U.S. dollars and weaken the trend of the gold market.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram