Worried about the second wave of the virus

While the world is eager to lift the ban on the virus, there will be another community outbreak one month after the national blockade is lifted in China, while Germany reports that the number of infected people is also increasing after the initial blockade is lifted.

Saudi Arabia, on the other hand, proposed a new agreement in addition to its previous offer to reduce the price, expecting oil-producing countries to reduce another 1 million barrels on the basis of the agreement starting in June. Previously, the agreed reduction was 10 million barrels.

The original factor that was good for oil prices was not matched by the second wave of virus attacks. Oil prices dropped to US$ 24.14 a barrel during the new york period, while the Dow Jones Industrial Average fell 110 to close. Oil prices are affected by short-term oil stocks.

The Federal Reserve Bank said last night that it would do its best to ensure that economic activity resumed in a safe situation, but expected the recovery in all sectors to be slower than expected. He reiterated that the interest rate will remain near zero for a long period of time.

In addition, he does not think negative interest rate is the best tool of the Federal Reserve.

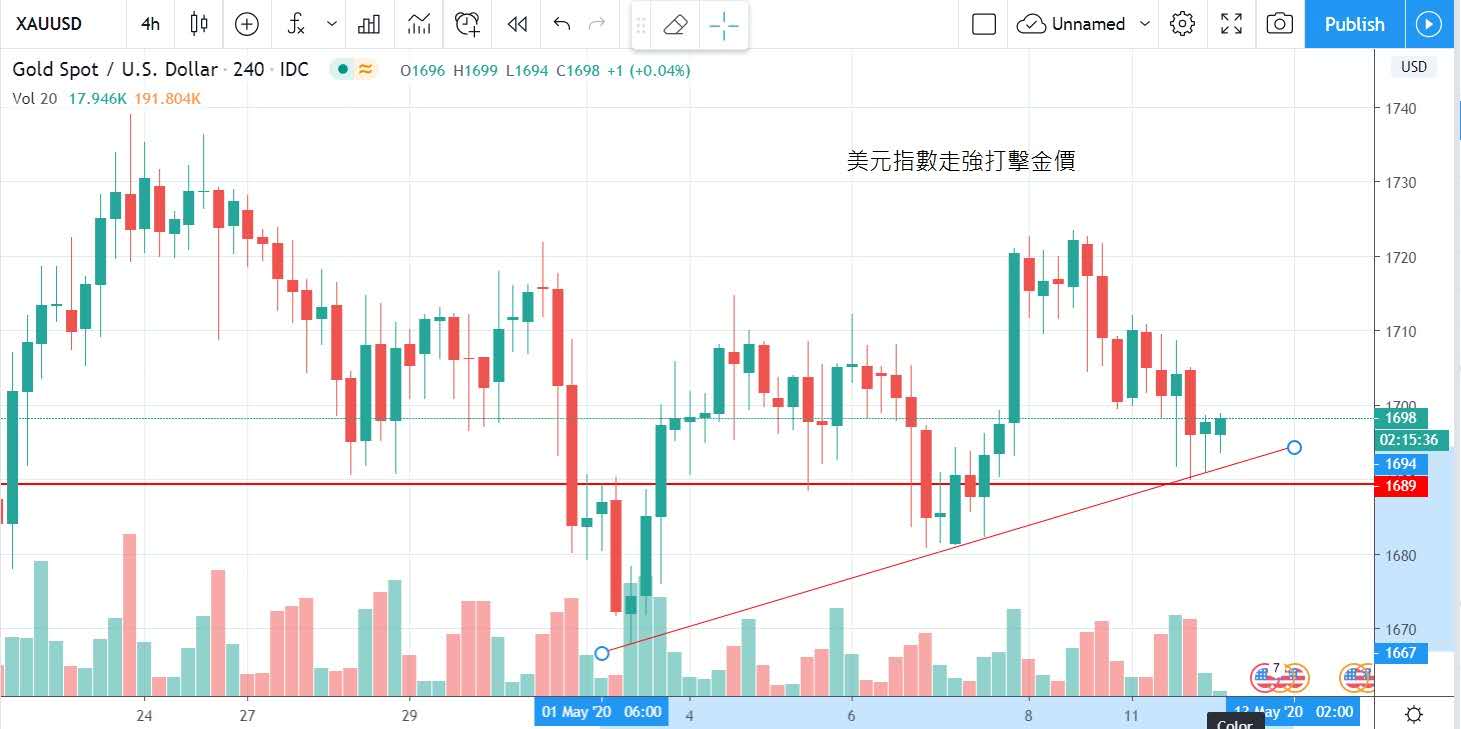

The market expects negative interest rates not to occur in the short term, but the close level of 0 also strengthened the US dollar, with the US dollar index closing at 100.2 and depressing gold prices. Gold lost 1,700 yuan and fell to a low of 1,692 to close at 1,698 in U.S. trading.

Gold price is entitled to benefit under the support of virus attacking economy and unlimited amount of money. However, investors lose their direction at this stage, which can not reflect their hedging function.

For detailed analysis and operation suggestions, please CLICK the following links to join the group and inquire with the administrator.

https://chat.whatsapp.com/Ippy9Pn5hjyEV7gtgCbVo0

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram