Weekly Review: Oil Price Smoothly Receives, Gold Price Expected to Rise Supported by Hedge Buying

We all witnessed an economic event on April 21, 2020! U.S. Crude Oil May Futures Price Plugged to minus 37 U.S. Dollars Closing,

The emergence of negative oil prices has become a hot topic in the entire investment community and has also overturned the imagination of some people who have no concept of investment.

Negative oil price is an abnormal phenomenon with various causes. Including the failure of crude oil producing countries to reach a cut-off agreement, resulting in overcapacity and the spread of new viruses across the world.

Economic activity is approaching a standstill, resulting in a sharp drop in demand, and crude oil storage is nearly saturated, resulting in high delivery and storage costs.

Forcing holders of long positions in May to close or change positions at lower prices before the deadline. However, this does not mean that crude oil is worthless. The June oil price futures can still remain at about 17 US dollars.

However, it is still unknown whether the black swan with negative oil price will reappear. Crude oil investors should be cautious and rational before the outbreak of the new pneumonia epidemic and manage risks well.

One stone hit a thousand waves, and the investment market was immediately controlled by panic. Stock markets and commodity prices all over the world followed the fall in oil prices on April 22.

Novel coronavirus is still one of the important factors that dominate the investment market. The global stock market rose on Friday (April 17) due to the availability of medicine.

However, last Friday (April 24) the Hong Kong stock market again reported that doubts about the efficacy of drugs contributed to the drop in the market. The Hang Seng Index fell 145 on that day and 670 all week.

The United States is still plagued by new viruses, with more than one-third of confirmed cases worldwide reaching 920,000 cases and more than 52,000 deaths.

The latest durable goods orders also fell 14.4% below the market expectation of 11.9%. The Dow Jones Index ended its three-week rally and fell 333% all week.

The epidemic control measures have dealt a severe blow to the revenues of the state governments. Georgia has ignored the opinions of the president and his health experts and allowed a series of small businesses, including the personal service industry, to reopen.

It is estimated that more states will join the resumption of the market in the future. However, enterprises are short of funds, the resumption of work is slow, the unemployment rate is high, and the national economy needs a longer time to recover.

Quantitative easing is still the most direct relief measure. The latest news is that Japan is also preparing to join the battlefield of unlimited quantitative easing.

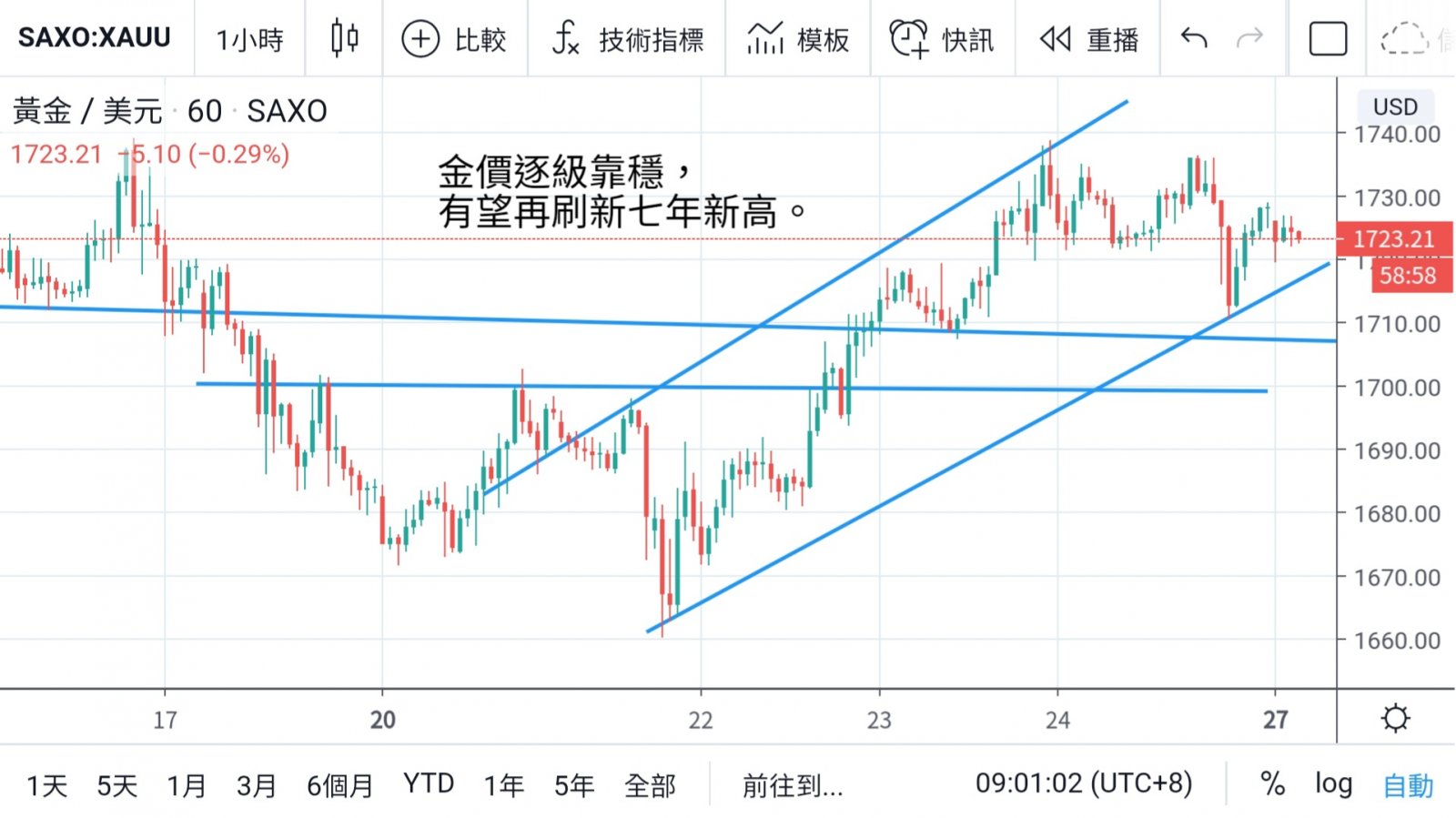

Gold prices fluctuated last week, mainly under the shadow of negative oil prices. Investors also became targets of selling under panic. On April 21, Hong Kong trading session dropped to 1660.

However, gold was immediately recognized as the best refuge for investment, and began to rise in European and American trading hours, with another wave of gains reaching 1740 this week.

On Friday, Hong Kong closed at 1,730. Although it fell to 1,710 in the U.S. opening session and then recovered to 1,730 left stones, members of the concerned group should have held about 1,670 stocks and closed their positions at about 1,740 to secure profits.

Happy weekend! And another gold search tour will be launched this week.

As far as the trend is concerned, as long as gold stays at 1710 level, it will challenge the high level of 1750 on April 15 first and then 1780. Although it will be achieved overnight, don't forget that the report by Daiichi Bank of America said that gold can rise to 3000 US dollars!

Therefore, the medium and long term is still promising. At this stage, the strategy is to lock in profits by selling low and selling high, and to seek opportunities to enter the market and accumulate wealth through every adjustment.

For detailed analysis and operation suggestions, please CLICK the following links to join the group and inquire with the administrator.

https://chat.whatsapp.com/Ippy9Pn5hjyEV7gtgCbVo0

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram