Comment: Scary Economic Data Supports US Dollar Stabilizing

After a long holiday in Hong Kong, the number of new cases in novel coronavirus has remained at the unit level every day. Readers are encouraged to continue to persevere for a while and take preventive measures to protect the health of themselves and those around them. Only in this way can it be meaningful to make money.

Hong Kong's stock market has performed poorly in the past week. The Hang Seng Index barely rose or fell in the first three trading days. On Friday, China's National Bureau of Statistics announced its GDP for the first quarter, which was 20.65 trillion yuan.

The quarterly decline was 9.8% and the annual negative growth was 6.8%, which was not only 6% lower than the market expectation, but also the first negative growth since 1992.

However, the expected adverse news was eased by the introduction of funds such as interest rate cut and rate cut. The Hang Seng Index rose to 24,620 and closed at 24,380 litres by 1.5% thanks to Ridgeway's ability to treat new pneumonia.

For the same reason, the U.S. stock market also rose sharply in the past Friday, with the Dow Jones index up 700 or 3%. This offset the decline caused by the following two bad data.

The United States announced last Thursday that the number of first-time applications for unemployment benefits increased by another 5.25 million last week (up to April 11). The United States was hit by the closure of economic activities due to the impact of the novel coronavirus epidemic and epidemic prevention measures.

In the past four weeks, a total of 22 million people have applied for unemployment benefits for the first time. The unemployment rate in the United States is currently at least about 17%.

Another piece of bad news is that US retail sales plunged 8.7% in March, the largest monthly decline in history. However, I'm afraid this record will be broken soon, because Trump officially declared a state of emergency in the United States in mid-March.

And launched a number of epidemic prevention measures to deal with novel coronavirus. The American consumer pattern is the main driving force of the American economy, contributing two-thirds to economic production. Retail sales have plummeted and GDP is expected to be hit hard in the first quarter.

Trump is eager to save the economy to improve his chances of winning the presidential election, even though he knows that the introduction of unlimited quantitative easing will lead to inflation.

However, this is the most effective method in the short term, knowing that drinking poison to quench thirst is a must. And commodity prices will eventually rise because of the flood of capital.

First, oil price. The trend of oil price is totally different from the performance of the U.S. stock market on Friday. The decline of oil price turned sharp on that day, reaching as low as 17.47 U.S. dollars. The closing price rose to 18.44 U.S. dollars and still fell 6.8%.

Oil prices are bound to fluctuate before oil-producing countries reach an agreement to cut production. However, oil commodities can already be put on the watch list or bought speculatively close to US$ 18, which is expected to return to 20 yuan's psychological barrier.

The good news for oil prices is that U.S. media reported that several state governments are about to announce timetables for easing epidemic prevention measures, hoping to restart the economy in May. It can be seen that doing a good job in the economy is the top priority of the U.S. government.

Whether it can be restarted in May is unknown, but it is an inevitable strategy to relax the restrictions in due course and step by step, and the limited resumption of work by the US Boeing Company this week is evidence.

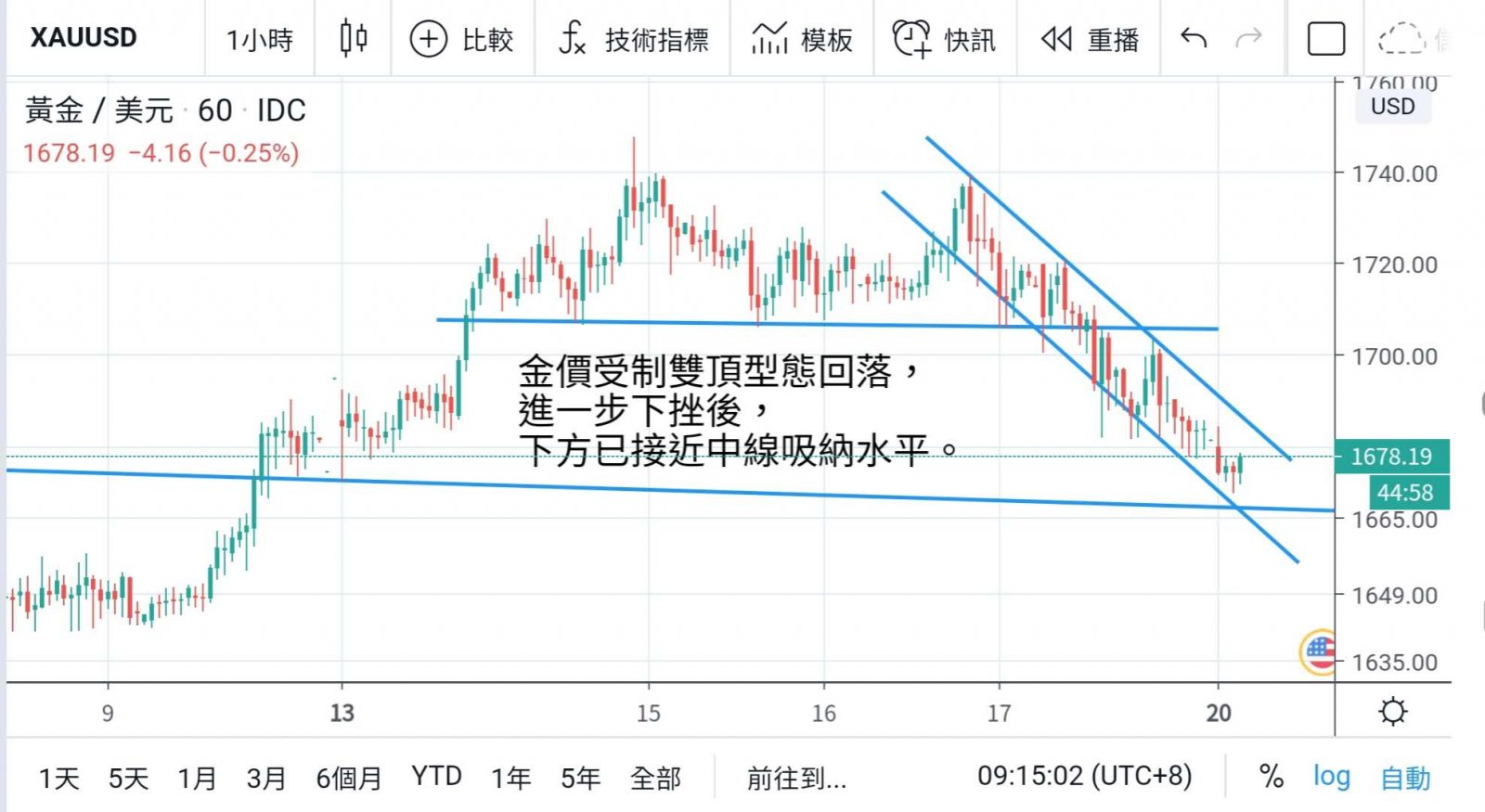

As expected last week, the price of gold rose above 1700 after breaking through 1683, and reached 1750 on April 15. Unfortunately, the rally was too rapid and many people made profits. On Thursday, the price of gold reached double-top and fell through the bottom line 1716 of this month's upward channel before returning to 1685.

Rise fast and fall fast. However, it is also a matter of time before the price of gold drops to its current level, and it is also a matter of time before it returns to 1700 or higher. When the price of gold softens to below 1670, it can begin to absorb while the price is low.

For detailed analysis and operation suggestions, please CLICK the following links to join the group and inquire with the administrator.

https://chat.whatsapp.com/Ippy9Pn5hjyEV7gtgCbVo0

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram