U.S. Dollar Becomes a Refuge of Funds under King Epidemic Situation

Central banks around the world joined hands to rescue the market. Last week, central banks and governments took turns to cut interest rates and began QE. With the outbreak of the novel coronavirus epidemic in Europe and the United States,

Risk sentiment is rising. Central banks dare not neglect the sharp decline in global stock markets. Many countries have cut their economic forecasts this year and next. Italy even calls the epidemic the most serious national crisis since World War II.

The US dollar is now playing the role of a fund refuge. The U.S. foreign exchange weighted index rose sharply in two weeks, reaching a peak of 103, a three-year high. Although it slightly vomited back last weekend, the upward trend has not changed.

The US Congress in see you on monday vetoed the trillion-dollar rescue plan. Stock markets in the Asia-Pacific region continue to be volatile. In addition to the US dollar, we can also pay attention to another safe haven asset, the gold market. After countries have stepped up their efforts to rescue the market, we believe that the gold price can start to stabilize in the short term and restructure its upward trend.

New crown pneumonia continues to erupt in the community and the epidemic situation in Europe and the United States is not well controlled. Apart from the response of the stock market, the economic sector is also beginning to come under increasing pressure. Morgan Stanley even released a report that said,

The newly crowned pneumonia epidemic will lead to a more severe recession than previously expected in the United States. In the second quarter, the gross domestic product will shrink by a record 30.1%, the unemployment rate will rise to 12.8% on average, and consumption will decrease by 31%.

The forecast is rather frightening. The report said U.S. economic activity nearly stagnated in March. As more regions adopt social distance measures and the financial situation improves and tightens, short-term GDP growth will show relatively negative growth.

At present, the S&P index of U.S. stocks trades at about 18 times earnings and the Dow is 15 times earnings. As the U.S. economy shrinks further, U.S. stocks will continue to decline next year. There is no room for optimism.

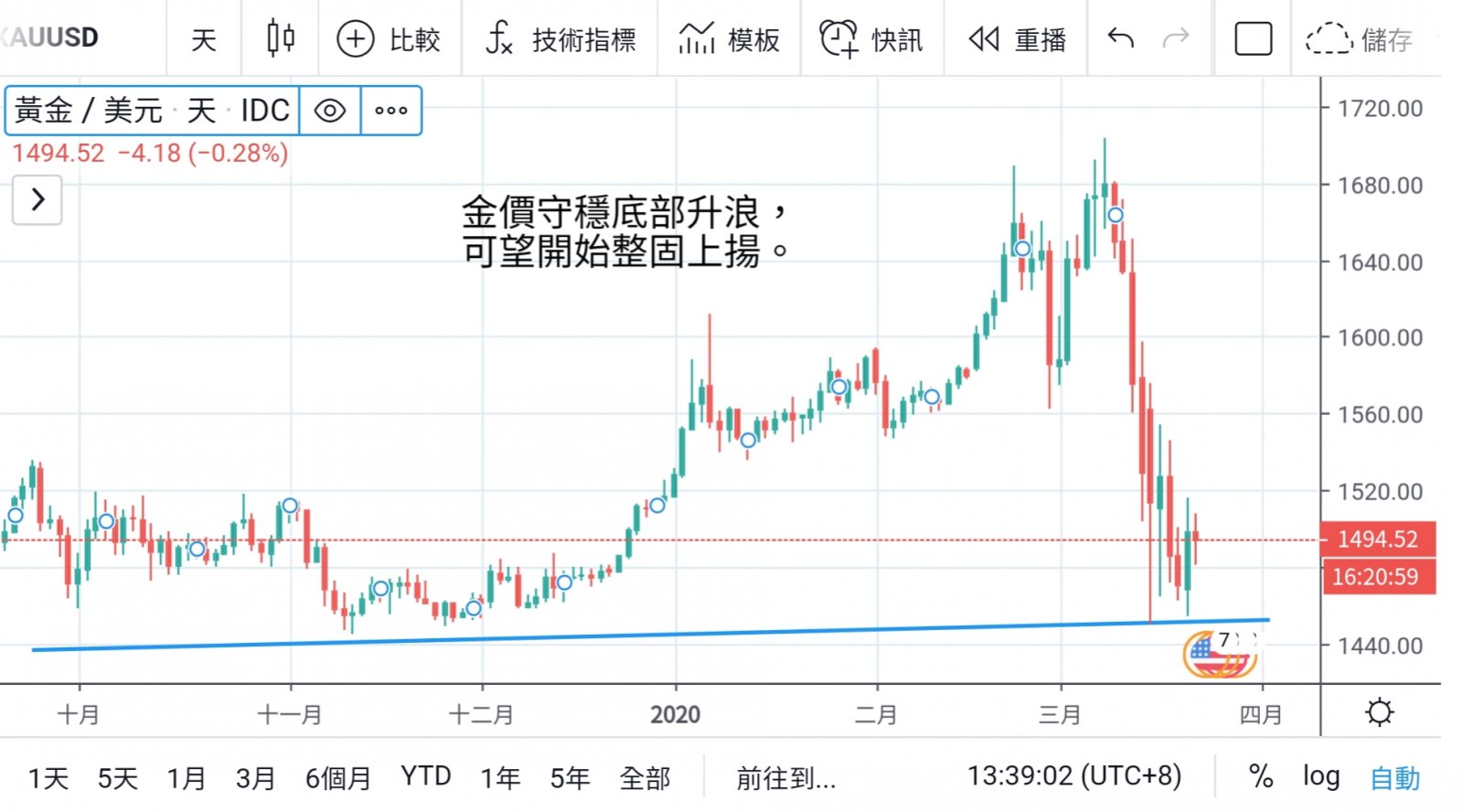

U.S. Congress failed to pass the trillion-dollar rescue plan on Monday, causing further shocks to the Asia-Pacific stock market and U.S. stock futures. The gold market has also seen some ups and downs. However, the gold market has gradually seen a stable trend during this period of U.S. dollar rise and U.S. stock decline.

I believe that the early round of long positions in Jinshi and long positions in U.S. stocks have begun to close. The gold market will begin to fluctuate again in response to market demand. Gold prices set a bottom in the mid-term, with 1450 below becoming the key support. Although it has repeatedly rebounded above 1500 and failed to stabilize.

However, as long as the market sentiment in this period starts to stabilize, this position is an ideal opportunity to absorb and can be absorbed at bargain prices. Although the rise of the US dollar has prevented gold from rebounding, many countries also believe that there will be funds to reabsorb gold as a hedge against risks when printing money.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram