The Bank of England's Sudden Interest Rate Cut Begins in the Year of Half a Percent Interest Rate Cut

The Bank of England suddenly cut interest rates by half a percentage point. All members unanimously agreed to cut interest rates by half a percentage point. Sterling against the US dollar and other major currencies came under pressure. The global low-interest environment once supported gold prices to hit a high level in 1670 days.

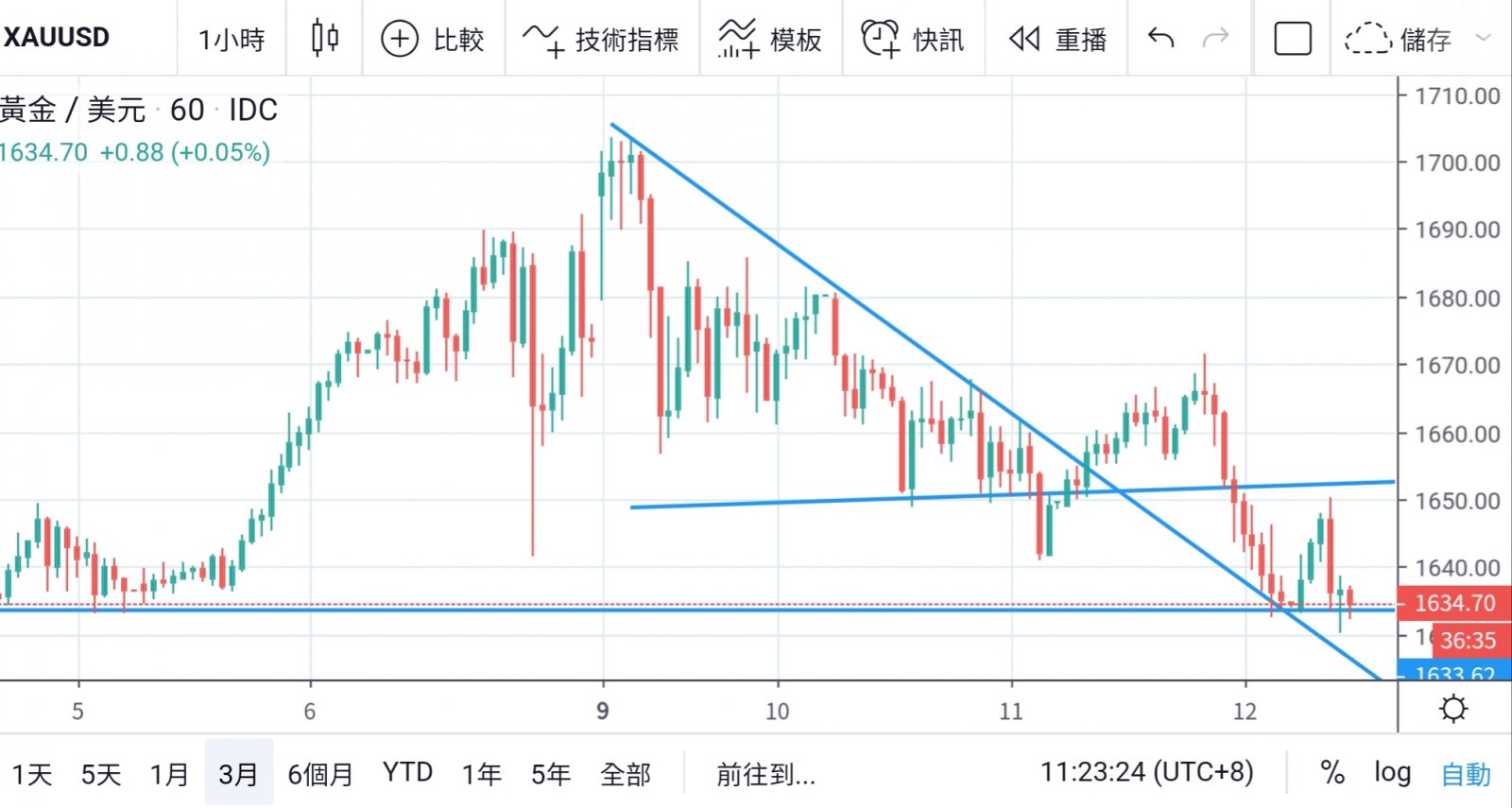

However, U.S. stocks collapsed again, tightening market funds and dragging gold prices to a new low in the week. Today, the European Central Bank is expected to follow the G7 interest rate cut and officially launch the global low-interest era.

In the face of novel coronavirus, countries will continue to make moves, the United States will issue a European ban, the World Health Organization will also characterize the new crown as a global pandemic, and financial markets will continue to suffer.

Although the gold price adjustment is almost complete, it is difficult to regain its upward trend in the short term and will make more consolidation in the new trading range.

Earlier in Europe yesterday, the Bank of England slashed interest rates by 0.5% to save the market in response to the severe epidemic of New Crown Pneumonia in economic activities. The target interest rate was reduced from 0.75% to 0.25%.

After the news was released, sterling prices plunged by more than 0.6%. The central bank statement pointed out that the authorities held a special meeting on Wednesday and officials unanimously agreed to cut interest rates by half a percentage point. The main reason was that the epidemic had caused the prices of risky assets and commodities to drop sharply.

As the interest rate on debt also fell to a record low, the economic prospects of Britain and the world deteriorated rapidly. I believe that with the urgent interest rate cut, the budget will also increase the scale of bond issuance.

The European Central Bank will do the same tonight. It is expected to cut interest on savings and increase the scale of bond issuance. The global zero interest era will come, but the gold market will not benefit immediately.

Although the low-interest environment has reduced the cost of holding gold for investors, due to the sluggish stock market, large funds have been dragged down to need funds to window-dress and move funds from the precious metal market to the stock market to replenish their positions, resulting in the decline of gold price.

Last night, the market originally expected US President Trump to introduce measures to rescue the market, but unfortunately his speech was silent and US stocks plummeted, which also led to another weekly low in gold prices. In addition, after news of the European Limit Order came out,

Global stock markets continued to panic this morning, with gold approaching US$ 1,630. Short-term gold prices failed to reverse their weakness. Investors needed more time to recover after the gold market was consolidated.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram