U.S. Stocks Collapse Triggers Suspension Mechanism Market Sentiment Not Optimistic

The oil group talks broke down, the market was worried about the possibility of price cuts, the financial market was deeply affected, US stocks plunged 2,000 points and triggered a stop mechanism, with the US dollar falling 1%.

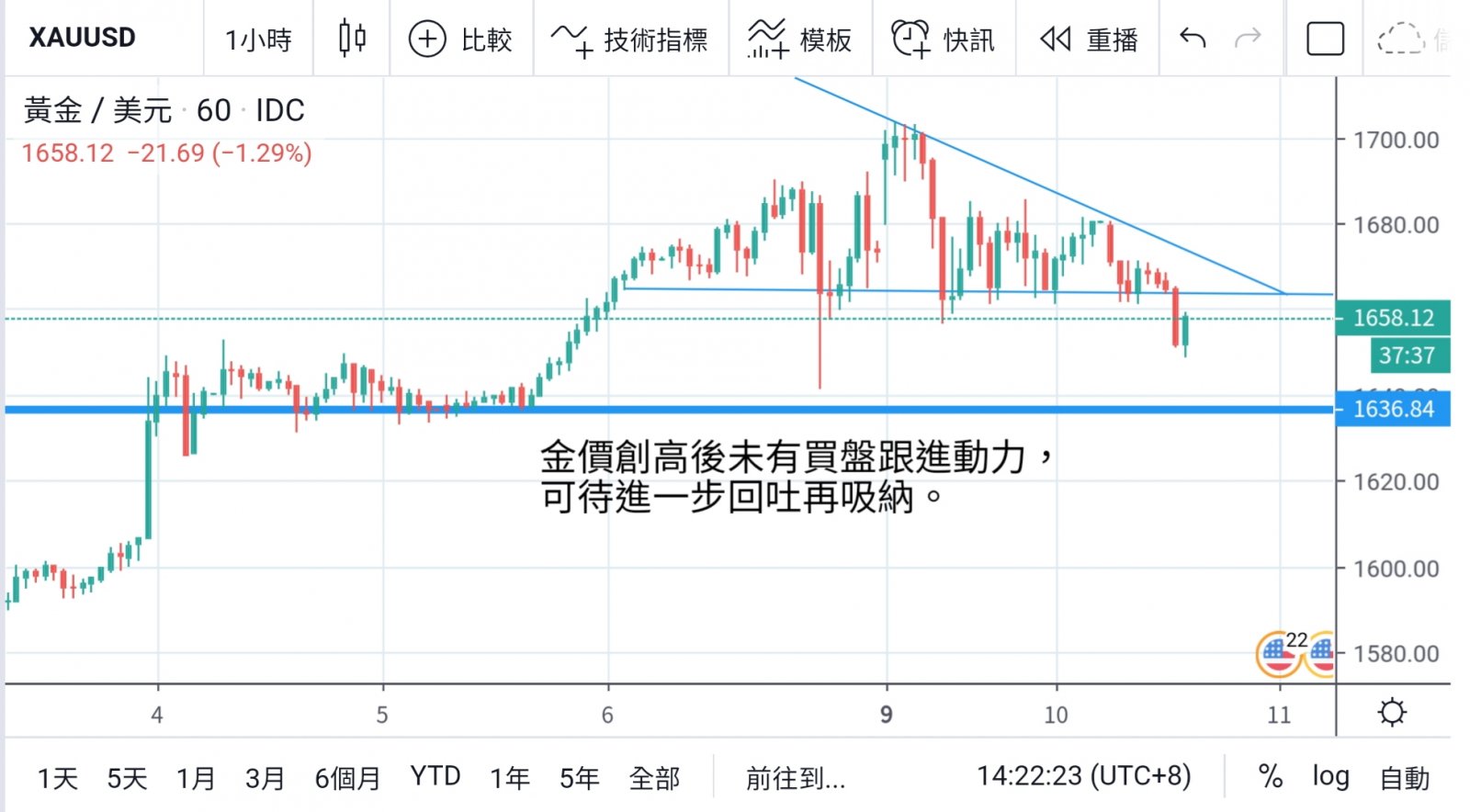

Oil prices have dropped more than 20%, financial markets are in turmoil, and funds have been diverted to the gold market for safe haven, hitting a seven-year high and breaking the US$ 1,700 mark. Unfortunately, the upward trend has not been sustained.

The short-term gold price performance is weak, and there is a possibility of further adjustment and another round of upward trend. However, the short-term trend of the US dollar is not optimistic.

The price war after the breakdown of the oil-producing countries' production cut talks, coupled with the outbreak of the new crown pneumonia in the world, has further shaken off the world's stock market, which had been hit hard previously.

U.S. stocks fell more than 7% as soon as they opened, triggering a market shutdown mechanism that would take 15 minutes to resume trading. After the resumption of trading, there was still no sign of calm in the market. After that, the market went down repeatedly, dropping 2158 points at most.

In the end, it closed at 23581, the biggest one-day decline in points and the biggest decline since October 2008 in percentage terms. U.S. stocks plummeted and global stock markets also saw setbacks.

The market may be said to have changed from a state of epidemic madness to a state of despair. It is in urgent need of quick adjustment. The global stock market has lost about US$ 7 trillion in market value in just two weeks. Money supply in the market has led to a very short supply. Investors are in urgent need of the central bank to rescue the market.

Although the price of gold rose above US$ 1,700 in the early period, there was no buying above it. In addition to the sharp decline in the stock market, funds also need to return to the stock market to replenish their positions from the gold market. Gold prices may return further.

Technically, after the gold price lost its 1660 level, it has the opportunity to further test its low position of 1642 last week. Although non-agricultural sectors performed well last week, the gold price repeatedly vomited back and forth, with a trumpet-shaped trend.

The trend of anti-development must be narrowed before it can develop smoothly. At this stage, we must wait patiently until the market starts to calm down, waiting for the golden opportunity of low absorption.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram