U.S. Stocks Fall Nearly 1,000 U.S. Dollars Again to Recent Low

Worried about further interest rate cuts by the Federal Reserve, the US dollar continued to fall last night, with the US-foreign exchange weighted index hitting a nearly two-month low of 96.47 and non-US goods rising across the board.

The U.S. dollar is in a precarious situation. After falling more than 1% last week, the U.S. dollar has the chance to record another one-week decline in two years.

This week's accumulation has also fallen by more than 1.5%. On the one hand, it has fallen close to the important support 100-balance moving average. Under the pressure of the US dollar, the gold price has also rapidly tested to a high level in the year.

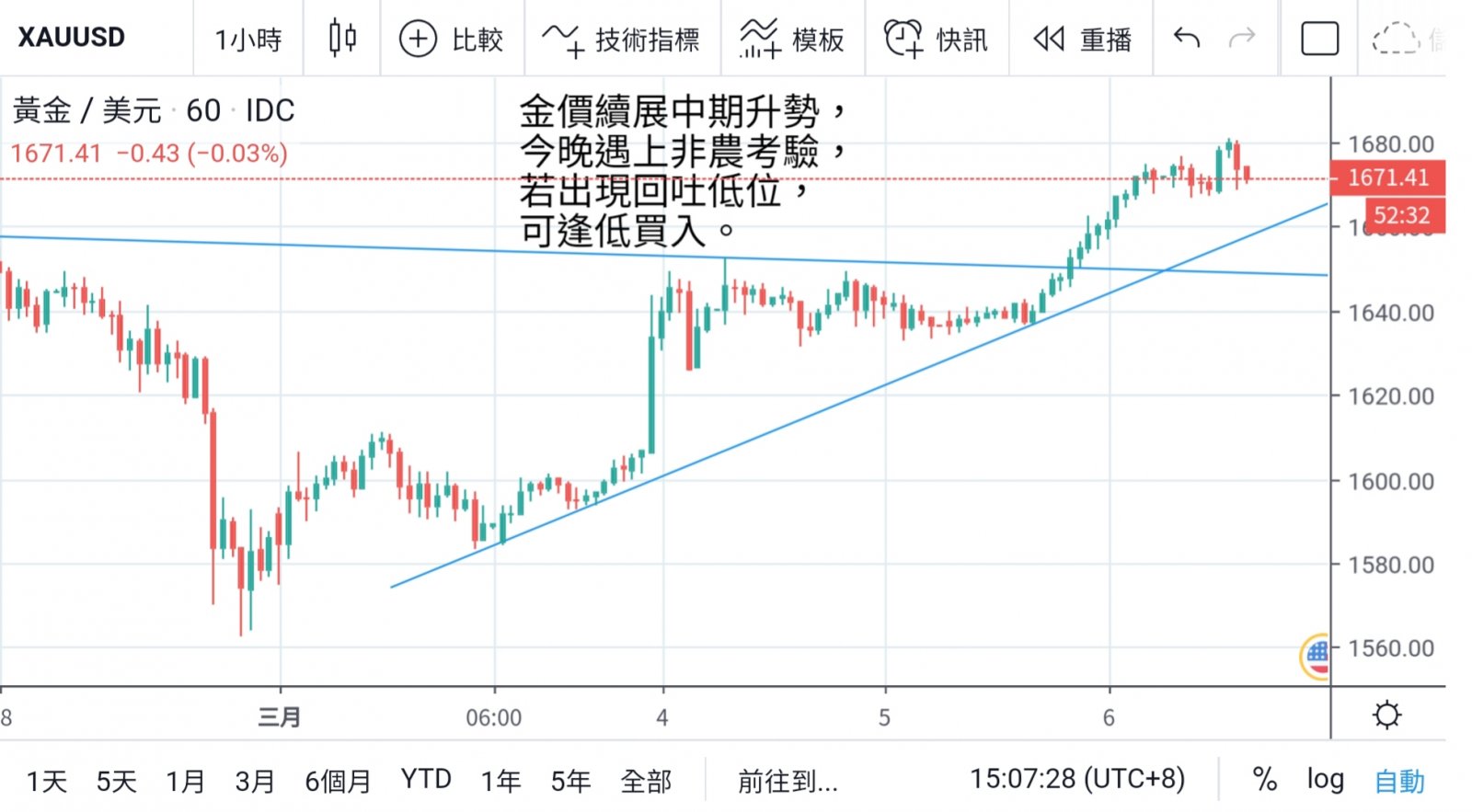

This morning I saw a high of 1,681 US dollars. I was under pressure from beginning to end, but I did not change my direction. The United States will release Labor Department data tonight. New jobs in non-agricultural sectors will be the focus of the week.

Since the data is not expected to be weak, if gold prices can be suppressed, they can buy at bargain prices and wait to break the year's high.

Since the Federal Reserve suddenly cut interest rates by a quarter of a percentage point on Tuesday, the US-foreign exchange weighted index has been bleeding profusely and financial markets have been in turmoil. Although the U.S. cut interest rates can solve the problem of money shortage for the immediate market,

But at the same time, it also hit the rise of the strong US dollar. Other non-US currencies gained momentum. In addition, novel coronavirus also wreaked havoc in the United States and the epidemic situation has subsided. The US dollar plunged even more yesterday.

It is the biggest one-day decline since January 9, 2019. Although the economic data recently released by the United States are mostly ideal, especially labor data,

For example, ADP's employment figures and the number of first-time applications for unemployment assistance last week were better than expected, but did not help the US dollar to rebound. Gold continued to break through late last night.

Gold prices hit a near-weekly high in Asian markets and then retreated. As the US will announce new non-agricultural jobs tonight, the market is paying more attention to them, so investors are wary of investing in high prices.

There has been no further push-up breakthrough. It is expected that the unemployment rate announced tonight in the United States will remain at 3.6, while the number of new non-agricultural jobs will drop slightly to 17.5. If the figure is released, it will represent more than 200,000 people.

But better than expected, it will bring immediate market support to the US dollar. However, the rise of gold price this week is a foregone conclusion. If gold price returns again, it may be a better buying position. Investors can take three steps.

Take a step back, buy back and wait for next week's breakthrough.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram