Global stocks fell nearly 2,000 points in two days

After falling more than 1,000 points on Monday, U.S. stocks fell 800 points last night, dropping 5.9 percent over the next two days, the biggest two-day cumulative point loss on record.

But the dollar also fell in tandem with the gold market, which failed to regain track after a one-day turn on Monday and a series of rallies yesterday. During the U.S. market's closing session, the dollar again tried the all-day low, dropping nearly $20 in 10 minutes.

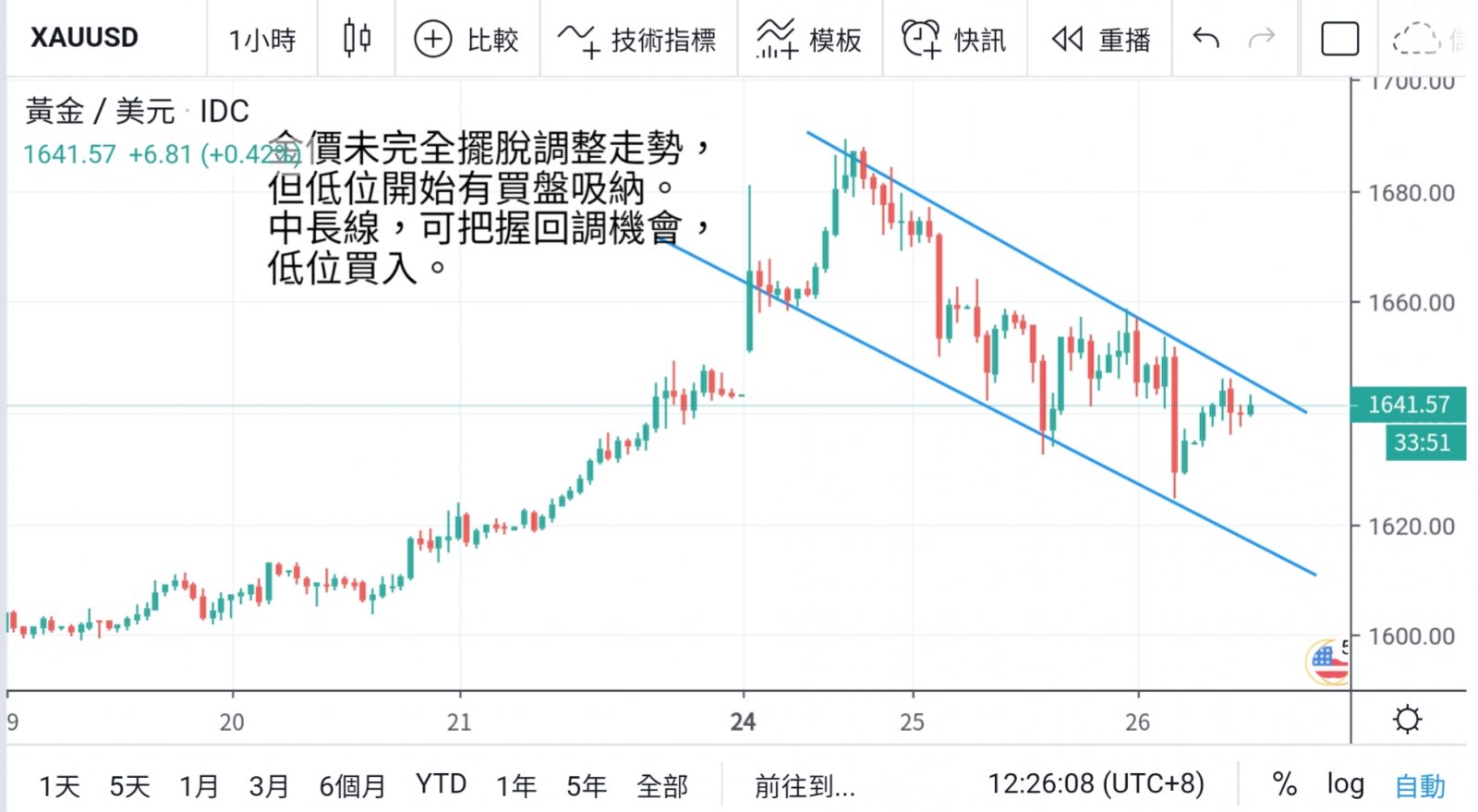

Early in the morning session as low as $1625, then rebound, the overall tone of gold is not out of the adjustment trend, the high has fallen some distance, selling pressure will slowly reduce, re-low, can start to absorb the low, is expected to start looking for bottom stability.

Following the previous night's stock market plunge, the European and Asian markets also saw a very bad atmosphere of siege yesterday morning, in addition to Japan, South Korea and Italy have been worried about a sense of community, the market also worried about the outbreak of the Middle East, the us secretary of state even admitted,

In the Middle East, there are cases of concealment epidemic, investors worry about the risk of economic recession, the stock market fell across the board; Despite safe-haven demand, gold's multiple rallies have failed to regain track. After hitting a seven-year high on Monday,

Profit unwinding plate has hit the gold market decline, the European market rebound to $1,658 again see pressure, although the expansion of volatility, but the trend is only limited to step by step.

On Wall Street, gold has been unable to regain its session high, with weak U.S. manufacturing data and consumer confidence data leading to further losses on Wall Street in the afternoon.

In addition to because the gold price has been up for a while, the fund by the impact of the U.S. stock market crash, the need for capital withdrawal market to cover short positions, so cut meat from the gold mayor warehouse, fund flow back to the stock market, so see the stock market and gold market yesterday appeared under the same time now.

Market volatility will begin to narrow after the week's severe market volatility. Gold will not immediately out of the adjustment pattern, the upper part of the more difficult to immediately return to the 1650 above, close to the position can be short term,

However, the low level of 1625 in the early hours of this morning is also very attractive in the medium to long term. As long as financial markets start to stabilize, funds will continue to absorb gold.

Markets are also starting to price in the fed's early rate cut to June on hopes that it will support gold prices in the medium to long run until the correction is complete, allowing gold to be reabsorbed in the middle.

Previous Article Next Article

Whatsapp

Whatsapp Telegram

Telegram